AI Tech Companies in China vs US: Best Investment Picks for Retail

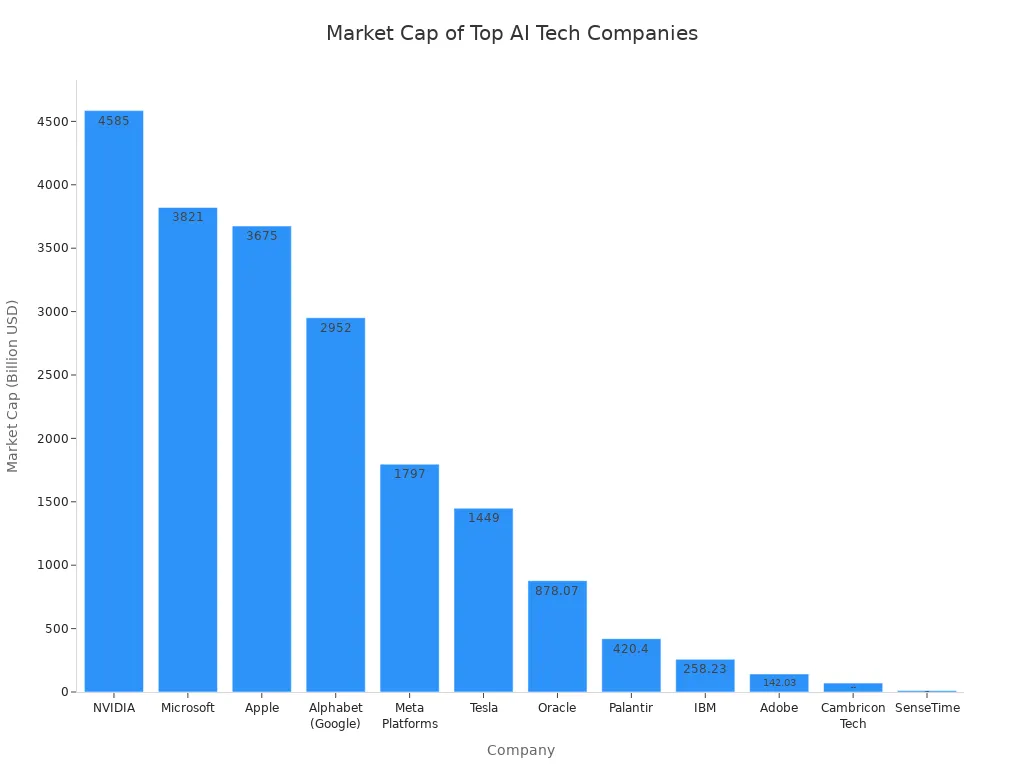

You can find top AI Tech Companies for retail investors in both the US and China. US leaders include NVIDIA, Microsoft, and Alphabet, while China features Cambricon Technologies and SenseTime. US companies have higher market caps, as shown below:

Name | Market Cap | Country |

|---|---|---|

NVIDIA | $4.585 T | USA |

Microsoft | $3.821 T | USA |

Alphabet (Google) | $2.952 T | USA |

Cambricon Technologies | $70.07 B | China |

SenseTime | $11.88 B | China |

Chinese companies recently posted a 30% annual growth rate, outpacing the US at 22%. You should weigh these trends with your own investment goals and comfort with risk.

Key Takeaways

Consider investing in US AI companies like NVIDIA and Microsoft for stability and strong market presence.

Explore Chinese AI firms such as Alibaba and Baidu for rapid growth potential, supported by government initiatives.

Evaluate your risk tolerance before investing; aggressive investors may prefer high-growth Chinese stocks, while conservative investors might choose established US firms.

Stay informed about market trends and regulatory changes that can impact AI investments in both countries.

Regularly review your investment strategy to align with your financial goals and adapt to market shifts.

Top AI Tech Companies

China Leaders

You can find several AI Tech Companies in China that stand out for their innovation and market strength. These companies have shown impressive growth and have become leaders in revenue and market share.

Tencent leads the market with strong investments in research and development. You see its products in gaming, social media, and cloud services.

Baidu ranks second, focusing on AI-driven solutions and autonomous driving. You notice Baidu’s technology in search engines and smart devices.

Xiaomi has climbed to fifth place by expanding from smartphones into electric vehicles and the Internet of Things.

iFlytek specializes in speech technology and AI, supporting education and communication tools.

Tip: You should pay attention to Alibaba and Baidu. Investors currently favor Alibaba over Baidu because Alibaba’s cloud and AI services have surged in demand.

You can compare the business models of top Chinese AI Tech Companies in the table below:

Company Name | Model Name | Type Of Model | Strengths | Use Cases |

|---|---|---|---|---|

DeepSeek | DeepSeek-VL | Code-Specialized, Vision-Language | High performance in math, programming, reasoning | Code generation, software debugging |

ByteDance | Doubao | Chatbot/Multimodal LLM | Fast Chinese language understanding | Content creation, Douyin integration |

Tsinghua KEG/Zhipu AI | GLM-4 | General LLM/Multimodal | Multilingual, long-text processing | Research, technical writing |

Alibaba DAMO Academy | Qwen 2.5-Max | General LLM | Enterprise-grade, strong API support | Automation, documentation, data analysis |

Baidu | Ernie Bot | Multimodal LLM | Integrated with Baidu search, vision-text | Knowledge retrieval, document summarization |

iFlyTek | Spark | Conversational/Education-focused | Multimodal, speech recognition | Speech-to-text, academic tutoring |

Megvii | Face++LLM | Vision-first LLM | Video analytics, identity recognition | Security, surveillance |

MiniMax | Minimax LLM | Conversational/Consumer-focused | High-speed inference, app integration | Social AI, chatbot apps |

Beijing Academy of AI | WuDao 3.0 | Super-scale LLM | Large Chinese knowledge base | Policy modeling, research |

Moonshot AI | Kimi (Kimi K1.5) | Chatbot/Long-Context focused | User-friendly, long-text summarization | Legal research, customer support |

Chinese AI Tech Companies have posted a 30% annual growth rate. You see Alibaba favored over Baidu in recent months, while SenseTime and Cambricon Technologies continue to expand their market share. These companies benefit from strong government support and rising demand for AI solutions in finance, healthcare, and manufacturing.

US Leaders

You find many AI Tech Companies in the US that lead the world in innovation and market capitalization. These companies have shaped the global AI landscape with their advanced technologies and strong financial performance.

NVIDIA stands out for its graphics processing units and AI chips. You see its products powering data centers and autonomous vehicles.

Microsoft invests heavily in cloud computing and AI research. You use its Azure platform for enterprise solutions.

Alphabet (Google) leads in search, advertising, and AI-driven products. You interact with its AI in everyday tools like Google Assistant.

Amazon uses AI for logistics, cloud services, and retail. You benefit from its recommendation engines and smart devices.

Extensity leads in enterprise-level ERP solutions, helping businesses manage resources efficiently.

SAS Institute, Inc. provides business intelligence and analytics, supporting decision-making in many industries.

ZS Associates, Inc. offers AI and analytics consulting, helping companies improve operations.

Infinite Computer Solutions, Inc. focuses on next-generation business technology.

DFX Latam specializes in web services and AI solutions.

Note: You should watch US stocks like Palantir, CrowdStrike, Zscaler, Snowflake, and Oracle. These companies trade near buy points and benefit from strong demand for AI technologies.

Recent market trends show that US AI Tech Companies had modest returns compared to China. The AI-INDEX rose by 2,225 basis points in 2024, with Palantir gaining over 492%. Ciena Corporation reported an 11.3% price gain. Some companies, such as DocuSign, faced declines, but most leaders remain strong. You see continued growth in the AI sector, with companies reaching all-time highs in 2025.

You can review the recent stock performance of leading US AI Tech Companies in the table below:

Year | AI-INDEX Performance | Key Performers | Notable Changes |

|---|---|---|---|

2024 | 60.8% | Palantir: +492.2% | Recovery from 2022 |

2025 | All-time high | Ciena: +11.3% | Continued growth in AI sector |

You should consider both the innovation output and financial stability when choosing which AI Tech Companies to invest in. US leaders offer better risk-reward profiles, while Chinese companies show faster growth and resilience.

Market Trends

Growth Drivers

You see many factors driving the rapid growth of AI Tech Companies in China and the US. In China, government initiatives play a big role. The government supports AI across many sectors and encourages self-reliance in technology. You notice that Chinese firms now seek funding from local sources and Gulf states because US investment has slowed. Many top AI scientists study in China and choose to work there, which boosts talent development. The government also works to improve data integration, making it easier for companies to use high-quality data. Cities like Hangzhou receive large investments in AI infrastructure, helping startups grow quickly.

Here is a table showing key growth drivers for Chinese AI Tech Companies:

Factor | Description |

|---|---|

Government Initiatives | Promoting AI in many sectors and focusing on self-reliance |

Capital Availability | Firms seek local and Gulf state funding as US investment declines |

Talent Development | Many elite AI scientists educated in China, more working domestically |

Data Integration | Government improves data quality and availability |

Large investments in AI startups and infrastructure, especially in major cities |

In the US, you see major tech firms increasing their capital spending. By 2025, these companies plan to invest $342 billion, a 62% jump from last year. Hardware investments rose 41% year-over-year, and data center construction hit a record $40 billion annual rate. US private AI investment leads the world, and more businesses now use AI as a core part of their operations.

Major tech firms plan $342 billion in capital expenditures by 2025.

Hardware investments increased 41% year-over-year.

Data center construction reached $40 billion annual rate.

US private AI investment leads globally.

AI is now central to business infrastructure.

Performance Overview

You notice that Chinese AI Tech Companies are expected to outperform US firms by 2025. Chinese companies show strong results in practical applications and open-source projects. Their AI deployment rate grows at 37% each year, especially in manufacturing and public services. Chinese firms share their AI models widely, while US companies keep their models secret. Chinese large language models perform as well as US models but cost less.

In 2025, Chinese AI Tech Companies reached ¥890 billion ($125 billion) in total investment, with 18% year-on-year growth and a 38% global market share. Government funding makes up 39% of total investment. Most activity happens in Beijing, Shenzhen, and Shanghai. Corporate investment in research and development reached ¥258 billion. By 2030, the sector could grow to ¥1.42 trillion.

Metric | Value |

|---|---|

Total Investment (2025) | ¥890 billion ($125 billion) |

Year-on-Year Growth | 18% |

Global Market Share | 38% |

Government Funding | ¥345 billion (39% of total) |

Sector Dominance | Autonomous vehicles (22%) |

Regional Concentration | 71% in Beijing, Shenzhen, Shanghai |

Corporate Investment | ¥258 billion in R&D |

Future Growth Projection | ¥1.42 trillion by 2030 |

You see US stocks offer better risk-reward, but Chinese stocks show resilience despite trade tensions and rising interest in AI.

Company Comparison

Strategy

You see that leading AI Tech Companies in China and the US use very different strategies to grow and compete.

In the US, private companies lead the way. The government steps back and lets businesses drive innovation.

In China, the government plays a big role. It sets up rules and helps companies with funding and support.

US companies focus on keeping their technology within a network of allies. They often add conditions to tech exports and want to keep their global lead.

Chinese companies offer their AI technology to more countries. They do not add political strings and try to make their AI outreach open and inclusive.

Here is a table showing some key partnership and expansion strategies:

Strategy Type | Description |

|---|---|

Global AI Cooperation | China uses Belt and Road partnerships to spread its AI influence. |

Targeting Underserved Markets | Chinese firms focus on developing economies and resource-rich partners. |

Development Assistance Approach | China includes AI in broader development help, such as training and partnerships. |

New 2025 Investment Plan | China plans to attract foreign AI companies with better treatment and fewer barriers. |

Opening Key Sectors | Sectors like telecom, healthcare, and education are now more open to foreign firms in China. |

You should remember that US companies often rely on private investment and global alliances, while Chinese companies use state support and focus on new markets.

Financials

You can compare the financial strength of top AI Tech Companies by looking at their revenue, spending, and profit margins.

Alibaba reported $34.2 billion in revenue with a 2% year-over-year growth. Its spending jumped by 225% to $5.35 billion.

Amazon and Microsoft each spent $320 billion on capital expenses over three years. Microsoft saw a 175% year-over-year revenue growth.

Alibaba spent $52.4 billion on capital expenses over three years. Its EBITA margin was 9.9%.

Baidu had a 26% year-over-year revenue growth and traded at a 40% discount compared to peers.

Here is a table to help you compare:

Company | Revenue (in billion) | Year-over-Year Growth | Spending (in billion) | Year-over-Year Spending Growth | Capex (3 years) | EBITA Margin | Revenue Growth Rate |

|---|---|---|---|---|---|---|---|

Alibaba | 34.2 | 2% | 5.35 | 225% | $52.4 billion | 9.9% | N/A |

Baidu | N/A | N/A | N/A | N/A | N/A | 40% discount | 26% YoY growth |

Amazon | N/A | N/A | N/A | N/A | $320 billion | N/A | Multi-billion $ |

Microsoft | N/A | 175% | N/A | N/A | $320 billion | N/A | 175% YoY growth |

Meta | N/A | N/A | N/A | N/A | $60-65 billion | N/A | N/A |

US firms spend more on research and development than Chinese firms. In 2025, Microsoft, Amazon, and Alphabet together plan to spend $180 billion on R&D. Alibaba, Tencent, and Baidu together will spend $35 billion. US companies have a higher R&D intensity at 13.5%, while China’s is 8%. Still, Chinese companies are catching up fast.

Innovation

You notice that both US and Chinese companies push the boundaries of AI, but they focus on different areas.

US companies like IBM, Google, and Microsoft file many patents for General Learning Models and Learning Techniques. They work on cloud computing and virtual assistants.

In China, companies like State Grid Corporation, Tencent, and Baidu file more patents for Learning Techniques, Training Data Generation, and Powertrain Control Systems. They focus on industrial uses and smart city projects.

By 2023, Chinese businesses spent about 95% as much on R&D as US firms. This rapid growth comes from strong government support and new tech-driven private companies.

Here are some recent trends:

In the US, there were 65,078 patent filings for General Learning Models and 46,408 for Learning Techniques.

In China, there were 157,114 filings for Learning Techniques, 74,589 for Training Data Generation, and 58,519 for Powertrain Control Systems.

Risks

You face different risks when you invest in AI Tech Companies in China and the US.

For Chinese companies, you should watch out for:

Market volatility, especially after new AI model launches that can shake up the market.

Cybersecurity threats, such as data poisoning and synthetic identity fraud.

Regulatory uncertainties, as rules can change quickly and affect your investments.

For US companies, you should consider:

Valuation and sentiment risk. Many stocks trade high on future hopes, not current profits.

Changing rules and regulations. New laws could impact how companies use AI.

Execution risk. Not all companies can turn research into real products.

Relying too much on a few providers. If a big provider has trouble, many companies could be affected.

Data dependency and model risk. Poor data can lead to bad results and hurt a company’s reputation.

Talent scarcity and operational bottlenecks. Not enough skilled workers can slow down progress.

You should always check your risk tolerance before investing. The AI sector moves fast and can change quickly.

Regulatory Environment

US Regulations

You see that the US does not have a single federal law for AI. This creates uncertainty for businesses and can make you think twice before investing. Some states, like New York, have their own rules. For example, New York’s Local Law 144 sets requirements for using AI in hiring. This can raise costs for companies and affect their profits.

Regulation Type | Description | Impact on Investment |

|---|---|---|

Federal Legislation | Uncertainty for businesses, may deter investment | |

State Legislation | Local laws like NY’s Local Law 144 for AI in hiring | Higher compliance costs, affects investment decisions |

Sector-Specific Frameworks | Guidelines for AI in insurance and other sectors | Encourages responsible use, may limit flexibility |

You also notice that the government takes action when companies misuse AI. The FTC recently stopped Rite Aid from using AI facial recognition for five years because of bias. This shows that regulators watch AI closely and can ban its use if needed.

"America’s AI Action Plan charts a decisive course to cement U.S. dominance in artificial intelligence. President Trump has prioritized AI as a cornerstone of American innovation..." — Michael Kratsios, White House Office of Science and Technology Policy Director.

China Regulations

You find that China uses national strategies and strict rules to guide AI development. The government requires companies to register their AI algorithms and pass security checks. These steps help keep AI safe and under control.

National strategies for AI development.

Regulatory frameworks that govern AI operations.

Industry collaboration to promote responsible AI development.

Regulation | Description |

|---|---|

Content Regulation and Censorship | Ensures AI follows local laws and standards |

Filing of AI Algorithms | |

Security Assessment | Needed for AI services that influence public opinion or social behavior |

China’s rules focus on privacy, ethics, and safety. New laws, like the Generative AI Measures, require companies to screen content and protect user data. The government also supports AI with funding and research programs.

Geopolitical Impact

You face new risks from ongoing tensions between the US and China. Trade restrictions and export controls slow down the growth of AI companies in both countries. Since 2009, import restrictions have affected almost 12% of global imports. Export controls now impact over 3% of global exports.

Chinese companies struggle to get advanced AI chips because of US export controls. This limits their ability to build powerful AI systems.

US companies face new rules and penalties in China, which can hurt their business.

DeepSeek had to limit access to its AI model because it could not get enough computing power.

Tencent Cloud’s leaders say that a lack of advanced chips slows AI adoption in China.

You should know that these tensions make AI investments riskier. Companies that rely on global supply chains or advanced chips may face sudden changes in their business.

Pros and Cons

Summary Table

You can compare the strengths and weaknesses of leading AI tech companies before you invest. The table below shows what sets Alibaba, Baidu, Alphabet, Amazon, and Microsoft apart. You see that each company has unique advantages and faces different challenges.

Company | Strengths | Weaknesses |

|---|---|---|

Alibaba | Economies of scale, diverse business portfolio, strong brand loyalty, advanced payment systems, innovative culture, efficient logistics, geographical advantage | Heavy dependence on China, regulatory challenges, counterfeit products, data privacy concerns, intense competition, global expansion difficulties, governance issues, reliance on small businesses |

Baidu | Advanced AI solutions, strong R&D, leadership in autonomous driving, integration with search | Regulatory scrutiny, competition, market volatility, dependence on domestic market |

Alphabet | Leading search engine, vast data resources, strong cloud services, global reach, innovation | Regulatory fines, privacy concerns, competition, high R&D costs |

Amazon | Powerful logistics, cloud dominance, customer loyalty, diverse revenue streams, innovation | Regulatory pressure, labor issues, competition, thin profit margins |

Microsoft | Cloud leadership, strong enterprise presence, high R&D investment, global partnerships | Antitrust scrutiny, competition, dependence on enterprise clients |

Tip: You should review each company’s strengths and weaknesses to match your investment goals.

Investor Fit

You need to think about your risk tolerance and investment style when choosing between Chinese and US AI tech stocks. If you want rapid growth and can handle market swings, Chinese companies like Alibaba and Baidu may suit you. China’s government invests heavily in AI and data infrastructure, which boosts confidence. The country’s large digital population helps companies train AI models quickly. You see industrial profits and retail spending rising, creating a good environment for tech firms.

If you prefer stability and global reach, US companies like Alphabet, Amazon, and Microsoft offer better risk-reward profiles. These firms invest in larger AI models and have strong international networks. You may face higher risks from big investments, but you get access to advanced technology and established brands.

You should also consider factors such as regulatory changes, trade frictions, and market skepticism. The China A-share market sometimes doubts economic recovery, which can affect stock prices. US tariffs and export restrictions may slow China’s AI progress. AI’s impact on jobs could lead to new regulations in both countries.

If you want high growth and can accept volatility, look at Chinese AI stocks.

If you want steady returns and lower risk, US AI leaders may fit your portfolio.

Always match your choices to your financial goals and comfort with risk.

You can match your AI tech investments to your risk comfort and goals.

Conservative investors may choose giants like Microsoft or Alphabet, keeping 70-80% in stable holdings.

Moderate investors might split 60/40 between core stocks and growth picks.

Aggressive investors could focus half or more on high-growth Chinese AI firms.

AI now gives you powerful tools for building smart portfolios once only available to professionals.

Review your investments often. Life changes can shift your goals, so keep your strategy up to date.

FAQ

What makes AI tech companies in China different from those in the US?

You see Chinese AI companies grow fast with strong government support. US companies focus on private investment and global partnerships. Chinese firms often share technology more openly, while US firms protect their innovations.

Can you invest in Chinese AI tech companies from the US?

You can invest in some Chinese AI companies through American Depositary Receipts (ADRs) or international funds. Always check your brokerage for access and review any restrictions before you buy.

Are AI tech stocks risky for retail investors?

AI tech stocks can be risky. Prices change quickly. You may face extra risks from new rules, trade tensions, or market swings. Always match your investments to your comfort with risk.

How do you choose the best AI tech company for your portfolio?

You should look at each company’s growth, financial health, and innovation. Compare their strengths and weaknesses. Think about your goals and how much risk you want to take.

See Also

The Future of Retail Lies in AI-Driven Stores

Understanding the Growth of AI-Enhanced Convenience Stores

A Comparative Analysis of Amazon Go and Cloudpick

Smart Stores: The Future of Convenience Retailing

Revolutionizing Retail: The Impact of Smart Vending Machines