The Evolution of Cash Vending Machines: From Coins to Digital Payments

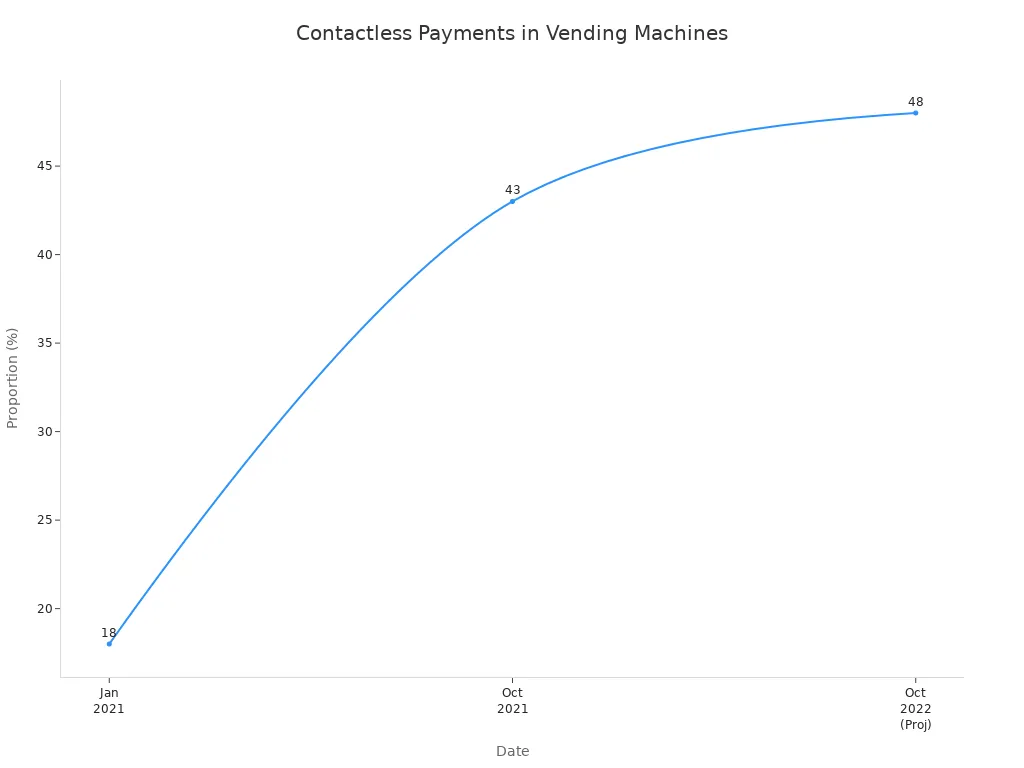

You now use cash vending machines without needing coins or bills. Most people choose digital payment methods like contactless cards and mobile wallets. This shift brings more convenience and faster purchases. Take a look at how quickly cashless options have grown:

Metric | January 2021 | October 2021 | October 2022 (Projected) |

|---|---|---|---|

18% | 43% | 48% | |

Cashless transactions for vending purchases | 51% | 62% | N/A |

Cash transactions for vending purchases | 49% | 38% | N/A |

Contactless transaction values (low-volume) | $7m | $14m | N/A |

You can now buy snacks or drinks in seconds.

You do not need to carry cash.

You enjoy quicker, easier, and more satisfying purchases.

Key Takeaways

Cash vending machines have evolved from coin-only systems to accepting digital payments, making purchases faster and more convenient.

Digital payment methods, like mobile wallets and contactless cards, eliminate the need for cash, enhancing customer satisfaction and increasing sales.

Operators benefit from cashless systems through higher revenue and better data insights, allowing for improved inventory management.

While digital payments offer many advantages, challenges like security risks and accessibility for all users remain important considerations.

The future of vending machines includes AI, IoT, and biometric technologies, promising even smarter and more personalized purchasing experiences.

Cash Vending Machines: Payment Evolution

From Coins to Cashless

You have seen cash vending machines change a lot over the years. In the past, you needed coins or bills to buy snacks or drinks. Now, you can use digital payment systems, making your experience much easier and faster. This shift from coins to cashless payment options marks a big step in vending machine evolution.

Biometric payments are revolutionizing how you interact with vending machines. These systems use unique physical traits, such as fingerprints, facial recognition, or palm scans, to authenticate transactions. They eliminate the need for cash or cards, offering a seamless and secure payment experience.

You do not have to worry about carrying exact change anymore. Most cash vending machines now accept digital payments, including mobile wallets and contactless payment systems. In 2024, cashless vending machines represented 75.0% of revenue in the U.S. This shows how much digital transformation has changed the way you pay.

Here is a table that compares coin-based and cashless systems:

Feature | Coin-Based Systems | Cashless Systems |

|---|---|---|

Payment Methods | Coins only | Credit cards, debit cards, mobile payments |

Customer Convenience | Requires exact change | No need for cash, easier transactions |

Maintenance Issues | Coin jams, bill acceptor problems | Connectivity issues, but no cash handling concerns |

Average Transaction Value | ~$1.25 | ~$2.50 or more |

Revenue Generation | Lower due to cash handling issues | 15-35% higher revenue due to increased transaction frequency |

Customer Demographics | Older customers may prefer cash | Younger customers prefer cashless options |

Risk and Complexity | Simpler, predictable | Higher earning potential, slightly more complex |

Data Insights | Limited tracking capabilities | Advanced data tracking for inventory management and customer preferences |

You can see that cashless systems offer more convenience and higher revenue. They also give operators better data insights, which helps them manage inventory and understand what you like to buy.

Card Readers and Digital Payments

The introduction of card readers in the 1990s changed how you pay at vending machines. You could now use credit and debit cards, which made payments faster and easier. This was the start of digital payment integration in cash vending machines.

The rise of mobile wallets like Apple Pay and Google Pay made it possible for you to pay with your phone. You no longer need to carry cash or cards.

Contactless payments let you tap your card or phone to complete a purchase. This makes transactions even quicker and more secure.

Internet-connected vending machines appeared in the early 2000s. These machines improved operational efficiency and transaction speed.

Impact on Vending Machines | |

|---|---|

Smart Payment Systems | Eliminates the need for coins, enhances speed, convenience, and security in transactions. |

Mobile Wallets | Allows purchases via smartphones, making transactions seamless and cashless. |

NFC Technology | Enables contactless payments, further enhancing convenience and speed. |

AI-Driven Solutions | Provides data insights for operators to optimize offerings and forecast demand, improving operational efficiency. |

Biometric Payments | Uses physical traits for authentication, offering a secure and seamless payment experience. |

Cryptocurrency | Introduces digital currencies for payments, making transactions faster and more secure. |

You have more payment methods than ever before. You can use card-based payments, mobile payments, or even digital currencies. This innovation has made buying from vending machines much easier.

In 2022, 67% of all vending machine transactions were cashless.

Cashless payments have led to more impulse purchases and higher spending. The average transaction value for cashless payments was $2.24, compared to $1.78 for cash transactions in 2024.

71% of vending machine transactions were cashless in 2024, showing a strong move toward digital payment systems.

You benefit from faster, safer, and more flexible ways to pay. Operators also gain from higher revenue and better data. The digital transformation of cash vending machines continues to shape how you interact with these machines every day.

Cashless Payments: Key Milestones

Early Coin Systems

You might find it surprising that the first cash vending machines appeared almost two thousand years ago. Hero of Alexandria invented a coin-operated machine in the first century. When you dropped a coin onto a pan, the weight tilted a lever and released holy water or wine. Once the coin slipped off, the valve closed, stopping the flow. This simple mechanism marked the beginning of automated payments and showed how people could use coins for self-service purchases. Early machines relied only on coins, so you always needed exact change to buy anything.

Bill Acceptors

As vending technology improved, you gained more flexibility with payments. Bill acceptors started appearing in the 1960s. You could now use paper money instead of just coins. The first machines accepted $1 bills, and later models took $5, $10, and $20 bills. This change made cash vending machines more convenient for you and increased their popularity.

Year | Innovation Description |

|---|---|

1964 | Introduction of $1 bill acceptance, enhancing payment flexibility. |

1987 | Launch of System 500, accepting $1, $5, $10, and $20 bills, expanding customer options. |

2000 | BX Bill-to-Bill Exchanger introduced, allowing for unattended operation in laundromats. |

Improvements in bill acceptor technology made payments more reliable. You experienced fewer rejected bills and smoother transactions. Hybrid payment systems started to appear, letting you choose between cash and digital payment systems.

Card-Based Transactions

You saw another big change when card-based payments arrived. Vending machines began to accept credit and debit cards. You no longer needed cash or coins. Card readers made payments faster and easier. You could tap or swipe your card, and the machine processed your purchase in seconds. This shift helped cashless vending machines become more common.

Digital Payments Era

You now live in a world where digital payments dominate. Mobile wallets, contactless payments, and QR code technology let you pay with your phone or smartwatch. Digital payment systems make transactions quick and hygienic. You can buy snacks or drinks without touching cash or coins.

Research shows that machines with digital payment systems see up to 35% more revenue. Some locations even report a 110% increase in sales. You spend more freely when you do not need exact change, and you often choose premium items or add extras.

The move to cashless payments removes barriers and makes you more likely to buy. Cashless vending machines outperform cash-only models, giving operators higher profits and better data.

You benefit from more payment methods, faster service, and greater convenience. Cash vending machines have evolved to meet your needs, making every purchase easier.

Digital Vending Machine Technology: Benefits

Convenience

You experience more convenience with digital vending machine technology than ever before. Interactive touchscreens make it easy for you to browse products, see prices, and get information about each item. You can use digital payment systems, including mobile payments, wallets, and contactless options, so you never need to search for coins or bills. These machines stay open 24/7, so you can buy snacks or drinks whenever you want.

Benefit | Description |

|---|---|

Provides around-the-clock access to electronic devices, allowing purchases at any time. | |

Enhanced Customer Experience | Enables quick, self-service transactions, meeting urgent needs without staff assistance. |

You also get personalized product suggestions based on your past purchases. This innovation improves your consumer purchasing experiences and keeps you coming back. Digital vending machine technology reflects your preference for fast, easy, and flexible payments.

Speed and Security

Digital vending machine technology speeds up your transactions. You can tap your card or phone for contactless payments, making purchases in seconds. Mobile wallets let you pay with a simple scan or tap, which is much faster than using cash. This speed helps you, especially in busy places like schools or offices.

Mobile wallets enable quick purchases with a tap or scan, reducing transaction time.

Contactless payments use encryption and tokenization, making your payments more secure.

Digital payment systems lower the risk of theft and fraud because you do not handle cash.

You enjoy a safer experience, and operators spend less time fixing cash-related problems. Digital payments also support sustainability by reducing the need for paper receipts and coins.

Real-Time Management

Operators use digital vending machine technology to manage machines more efficiently. Real-time data access lets them check sales and inventory levels from anywhere. Automated monitoring systems can solve up to 89% of traditional operational challenges.

Feature | Impact on Maintenance and Restocking |

|---|---|

Real-time data access | Enables remote monitoring of sales and inventory levels |

Advanced analytics tools | Helps analyze product performance and sales trends |

Automated monitoring systems | Eliminates up to 89% of traditional operational challenges |

Dynamic inventory optimization | Reduces downtime and minimizes waste |

You benefit from better-stocked machines and fewer out-of-stock items. Operators use predictive analytics to restock only what you want, which reduces waste and supports sustainability. Digital vending machine technology makes your experience smoother and helps businesses grow.

Cashless Challenges

Security Risks

You face new risks when you use cashless vending machines. Hackers target machines that do not have strong security. They can steal your personal and payment information. Fraudsters may exploit weak authentication and cause financial losses. Some machines are easy to tamper with, which leads to stolen products and expensive repairs. Poor network protection allows cybercriminals to inject malware or take control of machines. If operators do not secure machines, they may break data protection laws and face fines.

Data theft can happen if machines do not encrypt your payments.

Fraud risk increases when machines skip proper authentication steps.

Physical tampering causes inventory loss and damages machines.

Connectivity weaknesses let hackers attack machines remotely.

Compliance challenges arise when machines do not follow privacy rules.

You should look for machines with strong security features. These features protect your payments and keep your information safe.

Infrastructure Costs

You notice that digital vending machines cost more than traditional ones. The initial price for a digital machine is much higher. Operators pay extra for software, network connections, and regular updates. Maintenance costs also rise because digital systems need frequent checks and repairs. The table below shows how costs compare:

Type of Vending Machine | Initial Costs | Ongoing Costs |

|---|---|---|

Traditional Cash-Based Machines | Few thousand dollars | Lower maintenance costs |

Digital Vending Machines | Steep price tag | Higher due to software and connectivity expenses |

Operators must invest in new technology to support contactless payments. These upgrades improve convenience but increase expenses. You benefit from faster service, but operators must balance costs with sustainability.

Accessibility

You may find cashless payment methods easy to use, but not everyone does. Older adults and low-income groups often struggle with digital payments. Some people do not have bank accounts or smartphones, so they rely on cash. The elderly may miss out on government subsidies if machines do not accept cash. Poorer consumers face extra risks and costs when they cannot access cashless options.

Vulnerable groups may feel excluded from cashless systems.

The unbanked depend on cash and lack access to digital payment methods.

The elderly find contactless payments confusing and may lose benefits.

Poorer consumers risk further marginalization in a cashless environment.

You enjoy the speed and ease of digital payments, but you should remember that not everyone can access these benefits.

Future of Cash Vending Machines

AI Integration

You will see artificial intelligence change how you use vending machines. AI will learn your habits and suggest snacks or drinks you like. Machines will connect with smart city systems, so you can find them easily in parks, schools, or malls. AI will help operators save energy and reduce waste, making vending more sustainable. Some machines will use robots to restock themselves and prepare custom orders.

Role | Description |

|---|---|

Advanced Personalization | AI will enhance understanding of customer habits for hyper-personalized shopping experiences. |

Integration with Smart Cities | Vending machines will connect with urban infrastructure for seamless service across locations. |

Sustainable Automated Retail | AI will optimize energy use and reduce waste, promoting environmentally friendly practices. |

Robotics and Automation | AI combined with robotics will enable self-restocking and customized product preparation. |

AI-powered vending machines will boost profits by making your experience better and helping operators run machines more smoothly. You will notice features like sleep mode and smart inventory management that help the environment.

IoT Features

You will interact with iot-enabled machines that use sensors to track product levels and send alerts when restocking is needed. These machines will never run out of your favorite snacks because operators get real-time updates.

Sensors detect product quantities and send data to operators, eliminating guesswork.

Automated inventory management reduces manual effort and improves efficiency by sending alerts for restocking.

Smart machines track your preferences and suggest products based on your past purchases.

Interactive touchscreens and mobile payment options make your experience more convenient.

IoT technology will make vending machines smarter and more reliable. You will enjoy personalized suggestions and easy payments, including mobile wallets and contactless options.

Biometrics

You will soon use vending machines that recognize your face or fingerprint. Biometric authentication will make payments safer and faster.

Biometric systems use your physical traits as proof of identity, making transactions easier and safer.

Cameras verify transactions and capture images during purchases to improve security.

Facial recognition adds another layer of convenience and protection.

The vending industry is moving toward encrypted payment processes and biometric authentication. You will feel more secure when you buy snacks or drinks.

Cryptocurrency

You may pay for snacks with cryptocurrency in the future. Right now, about 3% of vending machine payments use crypto. Companies are testing new ways to accept digital currencies. The payment industry started looking at crypto soon after Bitcoin appeared in 2009.

Companies are exploring integration options, showing an emerging trend.

You will have more choices for payments, including digital wallets and cryptocurrencies.

Industry reports show that vending machines will keep growing. The market size will reach $104.02 billion by 2033, with a 4.05% annual growth rate. You will see more cashless and contactless payment systems, smarter machines, and a bigger focus on convenience.

You have seen cash vending machines transform from coin-only devices to advanced systems that support contactless and digital payments.

The adoption of cashless technologies has not only increased consumer convenience but also streamlined the operational aspects for vending businesses.

Increased sales and wider customer reach.

Enhanced security and real-time inventory tracking.

New challenges like transaction fees and data privacy.

Recommendation Type | Description |

|---|---|

Embrace options like QR codes, digital wallets, and card tap to meet changing consumer expectations. | |

Real-time Data Analytics | Utilize advanced technology to monitor inventory, track sales, and identify product trends effectively. |

You can expect smarter machines and more personalized experiences as technology evolves.

FAQ

What is a cash vending machine?

A cash vending machine lets you buy items like snacks or drinks without help from a person. You pay using coins, bills, cards, or digital methods. The machine gives you the product after you pay.

How do contactless payments work in vending machines?

You pay by tapping your card or phone on the machine’s reader. The machine uses wireless technology to process your payment quickly. You do not need to insert your card or enter a PIN.

Are digital vending machines safe to use?

Digital vending machines use strong security features. They protect your payment information with encryption. You should look for machines from trusted brands to keep your data safe.

Can I still use cash at modern vending machines?

Many new vending machines accept both cash and digital payments. Some machines only take cards or mobile payments. You should check the payment options before you try to buy something.

See Also

Transforming Vending Machines: Embracing Digital Over Coins

Vending Machines Revolution: Transitioning From Coins to Contactless

Advancements in Vending Machines: Snacks to Smart Innovations

Vending Machine Bill Acceptors: Evolving From Coins to Bills