Corner Store Loans: Key Features and Funding Solutions for Small Businesses

If you run a small shop or dream about owning one, you might wonder how to get the money you need. Corner store loans give you a way to start, buy, or grow your convenience or retail store. Many owners use these loans to help with daily operations or to expand. In fact:

14% of small businesses seek financing for starting a business.

15% look for funds to expand.

Understanding your options can make a big difference for your business. Think about what your store needs most right now.

Key Takeaways

Corner store loans provide quick funding options, often approved within 24 to 72 hours, helping you manage inventory and operations effectively.

These loans can be used for various purposes, including renovations, equipment upgrades, and purchasing inventory, allowing for business growth and stability.

Understanding eligibility criteria, such as credit score and revenue, is crucial for securing the right loan for your business needs.

Comparing different lenders and loan types helps you find the best rates and terms, ensuring you make informed financial decisions.

Working with financial advisors or support groups can enhance your chances of finding suitable loans and navigating the application process.

Corner Store Loans Overview

What Are Corner Store Loans

When you hear about corner store loans, think of them as special funding made just for small retail shops and convenience stores. You can use these loans for many reasons. Maybe you want to open a new store, buy an existing one, or just keep your shelves full. Some owners use them to fix up their shop or add new equipment.

Here are some common ways you might use corner store loans:

Pay for new construction, like building a fresh store or adding more space.

Buy an existing business if you want to take over a shop in your neighborhood.

Get new equipment, such as cold storage, kitchen tools, or even parking lot upgrades.

Refinance old debts to save money on interest.

Cover costs for things like pumps, underground tanks, or point-of-sale systems.

You do not have to wait long to get started. Many lenders offer quick access to funds. You can often get approved and receive money in as little as 24 to 72 hours. That is much faster than a traditional bank, which might take weeks. Most corner store loans range from $30,000 to $500,000 or more, so you can find an amount that fits your needs.

Tip: If you need money fast for inventory or repairs, these loans can help you keep your business running smoothly.

How They Help Small Businesses

Corner store loans do more than just give you cash. They help you grow, adapt, and stay strong in a busy market. You can use the money to upgrade your store, launch new services, or even start selling online.

Here is a quick look at how these loans can make a difference:

Impact Area | Description |

|---|---|

Working Capital | Flexible loans give you the funds to upgrade your store and work more efficiently. |

E-commerce Pivot | You can invest in technology to start online sales or offer delivery. |

Community Engagement | Financing helps you run marketing campaigns and build customer loyalty. |

You get the freedom to make changes when you need them most. Maybe you want to try a new product or reach more customers. With fast approval and funding, you do not have to wait long to put your plans into action.

Note: Alternative lenders often process applications much faster than banks, so you can act quickly when opportunities come up.

Key Features of Retail Business Loans

Loan Amounts and Terms

When you look for retail business loans, you want to know how much you can borrow and how long you have to pay it back. Lenders offer a wide range of loan amounts, so you can find something that fits your store’s needs. Some loans help you buy inventory in bulk, while others let you upgrade your equipment or expand your shop.

Here’s a quick look at the average loan amounts for different types of loans:

Type of loan | Average small business loan amount |

|---|---|

Online loans | $5,000 to $500,000 |

Short-term loans | $5,000 to $750,000 |

Business line of credit | Up to $1 million |

Microloans | $13,000 |

You can choose from short-term or long-term retail business loans. Some loans give you a revolving credit line, which means you can borrow, repay, and borrow again as needed. This works well if you need to buy inventory often or cover unexpected costs. Other loans have fixed terms, sometimes up to 30 years, which helps you plan your payments and manage your cash flow.

Let’s see how different loan types help retail store owners:

Loan Type | Purpose |

|---|---|

To help you start, buy, or expand your store. | |

SBA Equipment Loans | To finance things like point-of-sale systems and refrigerators. |

SBA 7(a) Line of Credit | To give you flexible funding for hiring, inventory, or growing your store. |

Tip: If you want to buy a lot of inventory at once, a line of credit or a short-term loan can help you get a better price from suppliers.

Eligibility Criteria

Before you apply for retail business loans, you need to know if you qualify. Lenders look at a few key things. They want to see that your business is stable and that you can pay back the loan. Here are the most common requirements:

Criteria | Requirement |

|---|---|

Time in Business | 3 months or more |

Average Monthly Revenue | $10,000 (or $120,000/year) |

Credit Score | At least 450 |

Most lenders also check your credit score, your revenue, and how long you’ve been in business. Some may ask for collateral or a personal guarantee. You might need to show a business plan that explains how you’ll use the money. Lenders also look at your industry, where your store is located, and the size of your company. They want to see your financial documents, too.

Here’s a quick checklist:

Credit score

Revenue

Time in business

Collateral or personal guarantee

Business plan for how you’ll use the funds

Industry, location, and company size

Financial documentation

If you go to a traditional bank, you usually need a credit score of 680 or higher. SBA lenders may accept scores between 620 and 680. Online lenders sometimes work with scores as low as 500, but you might pay higher interest rates.

Loan Type | |

|---|---|

Banks and credit unions | 680 or higher |

SBA lenders | 620 to 680 |

Online lenders | As low as 500 |

Retail business loans | Typically 680 or higher for traditional lenders |

Note: If your credit score is lower, you can still find loans, but you may pay more in interest or fees.

Application Process

Applying for retail business loans can feel overwhelming, but you can break it down into simple steps. Here’s what you need to do:

Gather Necessary Documentation: Collect your business plan, financial statements, tax returns, legal documents, and your credit report.

Meet with Lenders: Research lenders, prepare your questions, and explain why you need the loan.

Understand Loan Terms and Repayment: Read the loan terms carefully and make sure you know your repayment schedule.

Lenders usually ask for several documents. Here’s what you might need:

Documentation Type | Description |

|---|---|

Personal Background | Previous addresses, names used, criminal record, education, etc. |

Resumes | Proof of management or business experience. |

Business Plan | A solid plan with financial projections. |

Personal Credit Report | Review for errors before you apply. |

Business Credit Report | Needed if you already run a business. |

Income Tax Returns | Last 3 years of personal and business tax returns. |

Financial Statements | Signed personal financial statements for owners with big stakes. |

Bank Statements | One year of personal and business bank statements. |

Collateral | Details about assets you’ll use to secure the loan. |

Legal Documents | Business licenses, articles of incorporation, contracts, and leases. |

Tip: Organize your paperwork before you apply. This helps you move through the process faster and shows lenders you’re serious.

Interest Rates and Fees

Interest rates and fees can make a big difference when you’re managing retail business loans. Rates vary a lot, depending on the type of loan and the lender you choose. Here’s what you can expect:

SBA loans usually offer lower interest rates for business owners.

In late 2024, new urban small business term loans had an average fixed rate of 7.31% and a variable rate of 7.61%.

Rural variable loans averaged 7.15%, while fixed term loans averaged 7.44%.

Besides interest, you might see these fees:

Origination fee (to process your application)

Underwriting fee

Closing costs

Early payoff fee or charges for refinancing

If you want to save money, compare rates and fees from different lenders. Lower rates and fewer fees mean you keep more of your profits.

Note: Always read the fine print. Ask your lender to explain any fees you don’t understand before you sign.

Retail business loans give you the flexibility to grow your store, buy inventory, or upgrade your equipment. With the right loan, you can manage your cash flow, take advantage of new opportunities, and keep your business strong. When you understand the key features, you’ll feel more confident about managing retail business loans and making smart choices for your store.

Funding Solutions and SBA Financing Options

Types of Loans Available

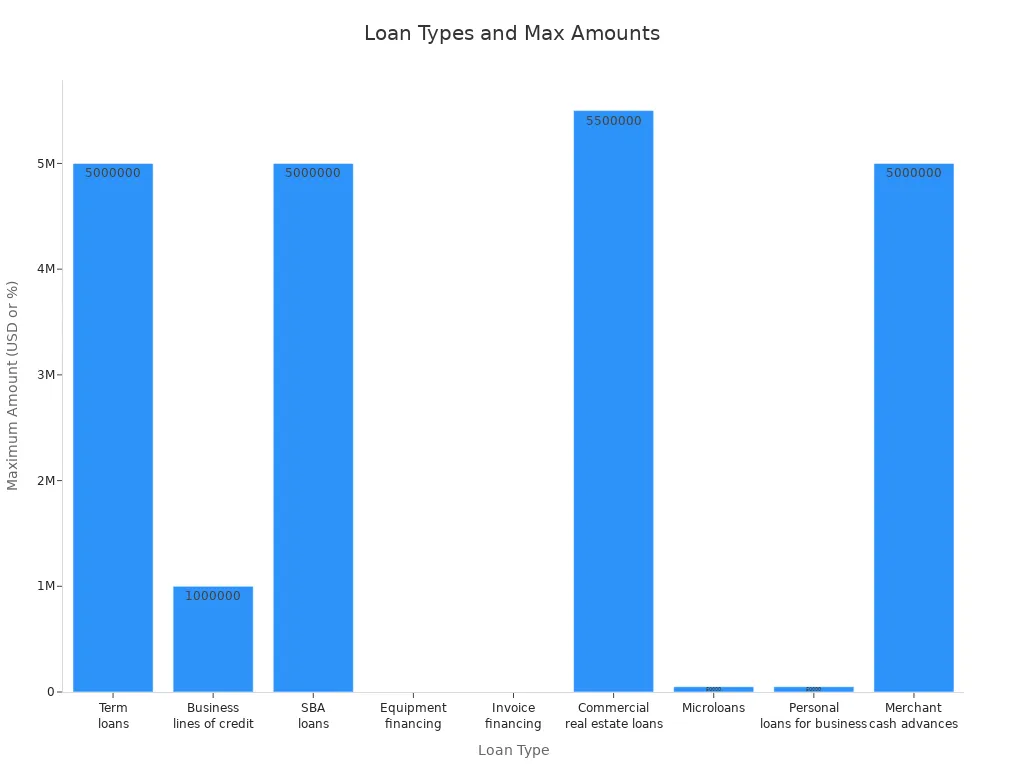

You have many financing options when you run a retail business. Some loans work best for quick needs, while others help with long-term plans. Here’s a table to show you the main types of loans and how they fit different goals:

Loan Type | Typical Amounts, Terms and Rates | Best For |

|---|---|---|

Term loans | Up to $5 million, 1 – 10 years, 6% – 99% | Investing in specific business areas or ongoing working capital |

Business lines of credit | Up to $1 million, Up to 5 years, 10% to 99% | On-hand, revolving capital for cash flow gaps or short-term expenses |

SBA loans | Up to $5 million, 10 to 25 years, Variable | Established businesses needing funding for many purposes |

Equipment financing | Up to 100% of equipment cost, 3 to 10 years, 4% to 45% | Buying or leasing equipment, machinery, or technology |

Invoice financing | Up to 90% of invoice value, Until paid, 1% to 5% of invoice value | Businesses with cash flow problems from unpaid invoices |

Commercial real estate loans | Up to $5.5 million, 5 to 25 years, 5% to 30% | Buying or renovating commercial property |

Microloans | Up to $50,000, Up to 25 years, Starting at 6% | New businesses needing a small amount of capital |

Personal loans for business | Up to $50,000, 2 to 7 years, 7.80% to 35.99% APR | Startup owners with good credit history |

Merchant cash advances | Up to $5 million, Paid daily/weekly, Factor rate 1.1 to 1.5 | Fast but expensive capital if you can’t qualify for other loans |

Tip: If you need flexible cash for inventory or emergencies, a business line of credit can help you cover gaps.

SBA 7(a) and SBA Financing Options

SBA loans stand out for retail businesses. The SBA 7(a) program is popular because it offers up to $5 million in funding. You get longer repayment terms and competitive rates. Here’s a quick look at what you can expect:

Feature/Benefit | Description |

|---|---|

Loan Amounts | Up to $5 million |

Interest Rates | Variable, often lower than private lenders |

Repayment Terms | Up to 25 years |

Uses | Working capital, equipment, real estate, more |

SBA Guarantee | 85% for loans up to $150,000; 75% for larger loans |

Collateral Requirement | All standard 7(a) loans need collateral |

Interest rates for SBA 7(a) loans depend on the amount you borrow. For loans over $350,000, you pay Prime + 3%. Smaller loans have slightly higher rates. SBA financing options also include microloans and real estate loans, so you can pick what fits your store.

Pros and Cons

When you compare SBA loans to other financing options, you see some clear advantages and disadvantages.

Advantage | Description |

|---|---|

Easier Access to Funding | SBA loans help businesses that banks might turn down |

Lower Down Payment | You may only need 10% equity, so you keep more cash |

Longer Repayment Terms | Up to 25 years, which lowers your monthly payments |

Government Guaranty | SBA backs the loan, so lenders take less risk |

Disadvantage | Description |

|---|---|

Strict Eligibility | You must meet tough standards for size and credit |

Extensive Paperwork | The application asks for lots of documents |

Personal Guaranty | You risk personal assets if your business fails |

Fees and Costs | SBA loans may have extra fees |

Note: SBA financing options give you better rates and terms, but you need to prepare for a longer application process.

Matching Solutions to Business Needs

You want to pick financing options that match your store’s needs. If you need money for inventory before a busy season, an inventory loan or business line of credit works well. For buying new equipment, equipment financing gives you fixed payments. If you plan to open a new location, SBA loans offer large amounts and long terms.

Loan Type | Use Cases | Repayment Structure |

|---|---|---|

Business lines of credit | Flexible, short-term expenses, cash flow | Revolving, pay based on usage |

Business term loans | Short-term projects, long-term investments | Fixed installments |

Inventory loan | Stock up for seasonal peaks | Regular or lump sum repayment |

Equipment financing | Buy or lease equipment | Fixed installments, option to own |

SBA loan | Major projects like new premises | Fixed installments at favorable rates |

Tip: Think about your business size, revenue, and goals before you choose a loan. SBA financing options work best for big plans, while lines of credit help with daily needs.

Choosing the Right Loan

Factors to Consider

Picking the right loan for your store can feel tricky, but you can make it easier by focusing on a few key things. Start by thinking about your business size and how long you have been open. Lenders like to see that your business has been running for at least two years and brings in steady revenue. If you are just starting out, a strong personal credit score can help you qualify for business financing.

Here is a table to help you see what lenders look for:

Factor | Description |

|---|---|

Personal Credit Scores | A score of 600 or higher helps you get better loan terms. |

Business Credit Scores | A Paydex score of 75+ shows you pay bills on time. |

Annual Revenue | Lenders prefer $100,000 to $250,000 or more each year. |

Time in Business | Two years or more makes you less risky to lenders. |

Industry | Retail stores may face stricter rules for some loans. |

You should also ask yourself how much money you need and what you will use it for. Some owners need working capital loans to cover daily costs, while others want a business mortgage to buy property. Think about how fast you need the money. If you need funds quickly, online lenders can move faster than banks.

Here is a simple checklist to guide you:

Decide how much funding you need.

Check your credit score and business history.

Think about how soon you need the money.

Choose the type of loan that fits your goal.

Tip: Always match your loan to your business needs. Don’t borrow more than you can repay.

Comparing Lenders and Offers

Not all loans are the same. You want to find the best deal for your business. Start by looking at different lenders, such as banks, online lenders, and credit unions. Each one offers different terms, rates, and fees.

Here is a table to help you compare loan offers:

Criteria | Details |

|---|---|

Up to $500,000+ | |

Loan Purpose | Property, inventory, or refinance |

Loan Term | 3, 5, 10, or 15 years |

Amortization | 15 to 30 years |

Leverage | Up to 80% of property value |

DSCR | At least 1.40 |

Credit Score Requirement | 660 or higher |

When you compare offers, look at these things:

Interest rates and fees

Repayment terms

Credit requirements

Funding speed

Here are some best practices for comparing loans:

Check the lender’s reputation and reviews.

Make sure the loan type fits your needs, like a business mortgage or line of credit.

Review the repayment terms and payment process.

Compare interest rates and extra fees.

See how fast you can get the money.

Test the lender’s customer service.

Note: The right business financing can help your store grow, but always read the fine print before you sign.

Corner store loans give you the chance to expand, upgrade technology, and keep your shelves stocked. Take a look at the main benefits:

Benefit | Description |

|---|---|

Open new locations or refresh your store’s look. | |

Inventory Optimization | Avoid empty shelves and keep customers happy. |

Technological Upgrades | Invest in better equipment for smoother operations. |

Cash Flow Stability | Manage ups and downs with steady cash flow. |

Before you apply, make sure you know your options and gather your documents. You can boost your chances by working with a financial advisor who helps you find the best loan and guides you through the process. If you want more support, check out groups like SCORE, NASE, or the National Retail Federation for grants and advice.

FAQ

How fast can you get approved for a corner store loan?

You can often get approved in as little as 24 to 72 hours. Online lenders move quickly. Banks may take longer. If you have your documents ready, you speed up the process.

What can you use a corner store loan for?

You can use the money for inventory, equipment, renovations, or even buying another store. Some owners use loans to cover payroll or marketing. The lender usually asks how you plan to spend the funds.

Do you need perfect credit to qualify?

No, you do not need perfect credit. Many lenders accept scores as low as 500. Higher scores help you get better rates. If your credit is low, you may pay more in interest.

What documents do you need to apply?

You usually need:

Business plan

Tax returns

Bank statements

Proof of revenue

Personal ID

Having these ready helps you apply faster.

Are there any hidden fees with these loans?

Most lenders list fees up front, but always check the fine print. Look for origination fees, closing costs, or early repayment charges. If you have questions, ask your lender before you sign.

See Also

Essential Corner Store Fundamentals and Their Importance

Launching a Cost-Effective AI-Driven Corner Store

Understanding the Growth of AI-Enhanced Corner Stores