How Zip Stores Revolutionize Buy Now, Pay Later Shopping

Zip Stores change the way you shop with buy now, pay later options. You get flexible payment plans, secure virtual cards, and instant approval for purchases.

You can split payments into four or eight interest-free installments.

Use Zip Stores online, in-store, or with the mobile app for a smooth experience.

Over 81,900 merchants support Zip, so you find it in many places you like to shop.

Both shoppers and retailers benefit from easy payments and increased loyalty. Zip Stores make shopping simple and different from old payment plans.

Key Takeaways

Zip Stores let you split purchases into four or eight interest-free payments, making shopping more affordable and budget-friendly.

You can shop easily online, in-store, or with the Zip mobile app, enjoying a smooth and secure checkout experience everywhere.

Zip’s technology helps retailers save money and improve shopping by connecting online and in-store systems for better service.

Using Zip gives you clear payment terms with no hidden fees, plus instant approval and helpful reminders to avoid missed payments.

Retailers benefit from higher sales and loyal customers when they offer Zip’s flexible payment options, creating a win-win for everyone.

Zip Stores and BNPL

What Are Zip Stores

You can think of Zip Stores as a network of retailers and brands that let you use buy now, pay later (BNPL) options powered by Zip. These stores give you the chance to split your payments into smaller, manageable amounts. You find Zip Stores both online and in physical locations, making it easy to shop the way you like. Many popular merchants, such as CardCash.com, have joined Zip Stores to offer flexible payment plans. This approach attracts younger shoppers, especially Millennials and Gen Z, who want more control over their spending.

Did you know? The BNPL model has seen explosive growth in recent years. Take a look at the numbers below to see how much BNPL has expanded:

Metric | 2019 Value | 2021 Value | Growth (%) |

|---|---|---|---|

Number of BNPL loans originated | 180 million | 970% | |

Dollar volume (GMV) of originations | $2 billion | $24.2 billion | 1,092% |

Average order value financed | $121 (2020) | $135 (2021) | ~11.6% increase |

These numbers show that more people are choosing BNPL options at Zip Stores every year.

How Zip Stores Work

You start by choosing a Zip Store, either online or in person. When you check out, you select Zip as your payment method. Zip then lets you split your purchase into four or eight payments, often with no interest. You get instant approval, so you do not have to wait. The process is simple and fast.

Zip Stores use advanced technology to make your shopping experience smooth. The platform connects all parts of the payment process, from purchase requests to vendor management. Large companies like Sephora and Discover use Zip to save money and make their systems more efficient. In fact, Zip’s platform has helped businesses cut over $4.4 billion in procurement costs in just four years. The software also uses AI to guide you and make approvals easier.

Over 40% of finance professionals want to automate purchasing.

63% say workflow is their biggest challenge.

More than 80% of decision-makers know about business process automation.

These facts show that Zip Stores use technology to make shopping and payments easier for everyone.

Payment Flexibility

Pay in 4 and Pay in 8

Zip Stores give you real control over your spending. You can choose to split your purchase into four or eight payments. This flexibility helps you manage your budget and avoid large, one-time expenses. Many shoppers like having choices at checkout. In fact, almost half of US shoppers say payment choice is very important when they shop.

Statistic Description | Data Point | Explanation |

|---|---|---|

Importance of payment choice | 48% of shoppers | Nearly half of US shoppers want merchants to offer different payment options |

BNPL merchant adoption | Nearly 50% online | Almost half of online merchants now offer BNPL at checkout |

Shopper interest in BNPL | 40% of shoppers | Four out of ten shoppers would pick BNPL for big purchases |

You can see that flexible payment plans are not just a trend. They are becoming a standard in modern shopping. When you use Zip’s Pay in 4 or Pay in 8, you break down your payments into smaller, easier-to-handle amounts. This makes it less stressful to buy what you need or want.

Tip: If you want to avoid missing payments, set reminders on your phone for each installment.

Many people switch payment methods to find what works best for them. In 2023, 16% of shoppers tried new ways to pay, and a big reason was the desire for more flexibility.

Interest-Free Options

You do not have to worry about extra costs with Zip’s interest-free plans. When you choose Pay in 4 or Pay in 8, you pay only the purchase price. No hidden fees or surprise interest charges. This clear approach helps you plan your spending and avoid debt.

Customers value flexible and simple payment options because they make checkout easier. Complicated payment steps can cause 21% of shoppers to leave their carts without buying. When you use Zip, you get a smooth, fast checkout. This keeps shopping fun and stress-free.

Zip also works with consumer groups to make sure you get fair treatment. The company meets with financial counselors to discuss customer needs and satisfaction. You can trust that Zip puts your interests first.

Seamless Shopping Experience

Online and In-Store Integration

You want shopping to feel easy, no matter where you are. Zip lets you use buy now, pay later at both online and physical stores. This means you can shop from your phone at home or visit your favorite store in person. You get the same flexible payment options everywhere.

Retailers that connect their online and in-store systems give you more choices. You can see and test products in person, which helps you feel confident before you buy. When you pick up your order in-store, you might find something else you want. In fact, more than 37% of shoppers make extra purchases when picking up orders, and this number jumps to 86% during busy seasons. Stores that offer both online and in-store shopping build trust and make you feel supported.

Here are some ways seamless integration helps you:

You can check if a product is in stock before you visit the store.

You get real-time updates on product availability.

You can buy online and pick up in-store, saving time.

You enjoy a smooth checkout process, whether online or in person.

You experience the same brand and payment options everywhere.

Retailers use technology to connect all their sales channels. This helps them give you a better experience and makes shopping more fun. Companies that use unified commerce platforms can offer you personalized deals and keep your information safe. They can also expand into new markets by adding local payment methods.

Note: The best shopping experiences come from stores that blend online and in-store options. This approach helps you shop the way you want and keeps you coming back.

Zip Card and Mobile App

You can use the Zip Card to pay for your purchases in four or eight installments. The Zip Card works like a virtual credit card. You can use it online or in stores that accept major card networks. This gives you more freedom to shop where you want.

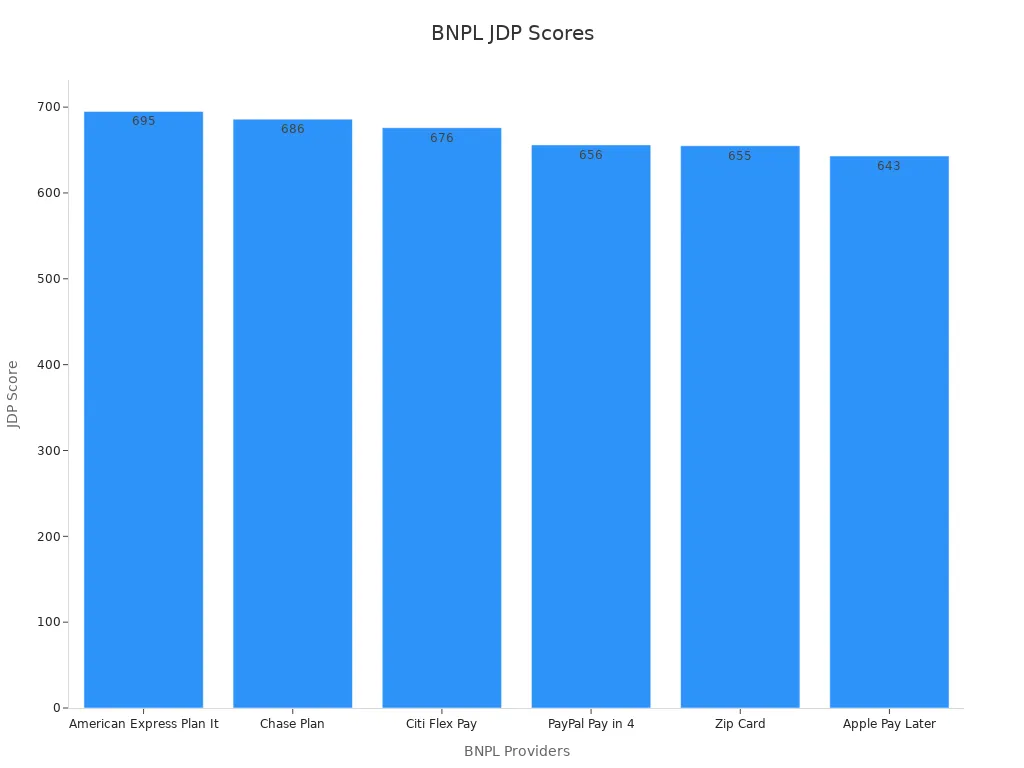

The Zip Card ranks high among buy now, pay later providers. According to a J.D. Power study, the Zip Card scored 655 out of 1000. This puts it ahead of many other specialist BNPL providers, including Apple Pay Later, Klarna, Sezzle, and Affirm.

BNPL Provider | J.D. Power Score (out of 1000) | Relative Ranking |

|---|---|---|

American Express Plan It | 695 | 1st (Highest satisfaction) |

Chase Plan | 686 | 2nd |

Citi Flex Pay | 676 | 3rd |

PayPal Pay in 4 | 656 | 4th |

Zip Card | 655 | 5th (Specialist BNPL provider) |

Apple Pay Later | 643 | Below Zip Card |

Klarna, Sezzle, Afterpay, Affirm | Below average (618 for Affirm) | Lower rankings among BNPL providers |

You can manage your Zip Card and payments easily with the Zip mobile app. The app lets you track your spending, set reminders, and make payments on time. Many users say that shopping apps are faster and easier to use than mobile websites. You can search for products, place orders, and pay with just a few taps. The app saves you time and effort, making shopping more enjoyable.

Research shows that people like using mobile apps because they are convenient and quick. You can avoid long lines and finish your shopping in minutes. The app also helps you stay organized and keeps your payment information secure.

Tip: Download the Zip app to get the most out of your shopping experience. You can use the app to shop at Zip Stores, manage your Zip Card, and find new deals.

Benefits

For Shoppers

You get more control over your money when you use buy now, pay later at Zip Stores. You can split your payments into smaller parts, which helps you manage your budget. Instant approval and one-tap payments make checkout fast and easy. You can shop online or in-store, and you always know what you will pay because fees and costs are clear from the start.

Convenience: You can pay with your phone, computer, or in person. The process works smoothly on any device.

Flexibility: Choose how you want to pay—credit card, debit card, bank transfer, or PayPal. Pick a payment plan that fits your needs.

Transparency: You see all fees, taxes, and shipping costs before you buy. The app shows you every detail, so there are no surprises.

Live chat support and progress bars during checkout help you finish your purchase without stress. Secure payment systems protect your information and keep your shopping safe.

A recent study found that shoppers enjoy easy payment management, quick access to credit, and a better shopping experience with BNPL services. You can shop with confidence and enjoy more freedom in how you pay.

For Retailers

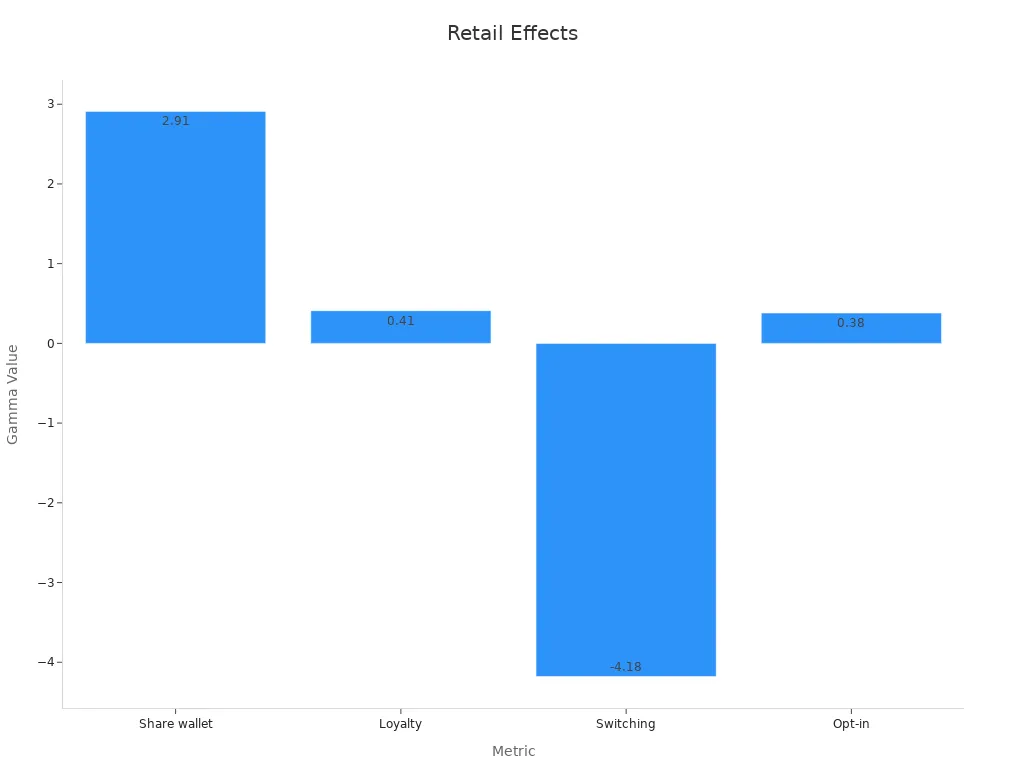

Retailers see big advantages when they offer BNPL through Zip Stores. More shoppers complete their purchases, and stores see higher sales. Customers come back more often, which builds loyalty. Retailers can also use data to create better shopping experiences and keep customers happy.

Benefit | Impact on Retailers |

|---|---|

Increased share of wallet | |

Greater loyalty intentions | γ = 0.41 (p < .001) |

Reduced switching intentions | γ = -4.18 (p < .001) |

Higher opt-in to data sharing | γ = 0.38 (p < .001) |

Economic reports show that BNPL services can bring billions in extra sales and save retailers money by improving conversion rates and encouraging repeat purchases. Retailers also find it easy to add BNPL options to their stores, making it simple to meet customer needs and grow their business.

Overcoming Challenges

POS Integration

You may notice that not every store offers buy now, pay later at the checkout. Many retailers struggle to add BNPL options to their point-of-sale (POS) systems. Each POS system has its own setup, which makes integration tricky. Some stores worry about technical problems, staff training, and how customers will react.

Many stores find BNPL adoption low in physical locations because of awareness and technical complexity.

Retailers face challenges with different POS systems, each with unique needs.

Staff need training to help you use BNPL smoothly.

Some shoppers do not know BNPL is available in-store.

Companies like SensePass help solve these problems. They offer a universal solution that supports many BNPL providers, including Zip. This makes checkout easier for you and reduces the technical work for store staff. You do not need extra apps or complicated steps.

A seamless POS integration can boost your shopping experience. Stores that connect BNPL to their systems see higher sales and stronger customer loyalty. For example, some e-commerce stores saw a 30% sales increase and reached over 42,000 active users after adding BNPL.

Retailers often follow a step-by-step process to add BNPL to their POS:

Research BNPL providers and understand their terms.

Check if their POS system is compatible.

Develop a plan for integration.

Access and test API documentation.

Add BNPL features and test the system before launch.

When stores use BNPL data, they can offer you special deals and loyalty programs. This encourages you to shop more and come back often.

Customer Education

You might not know about BNPL options unless someone tells you. Zip and its partners use several ways to teach you about these features.

Stores place signs at entrances, checkout counters, and near popular products to catch your attention.

Retailers work with Zip to create clear messages that explain BNPL benefits.

Store associates receive training so they can answer your questions and guide you through the process.

You get a consistent experience whether you shop online, in-store, or with the app.

Tip: Look for BNPL signs or ask a store associate if you want to learn more about payment flexibility.

Mallory Burstein, a Senior Merchant Development Manager at Zip, says that good signage, helpful staff, and clear communication help more shoppers use BNPL. When you understand your options, you feel more confident and supported during your shopping journey.

Zip Stores set a new standard for buy now, pay later shopping. You enjoy flexible payments, clear terms, and easy access both online and in-store. Retailers see higher sales and stronger loyalty. The future looks bright for BNPL. Market forecasts show rapid growth and new technology trends:

Year | Market Size (USD) | CAGR | Key Trends |

|---|---|---|---|

2024 | 48.4% | AI, mobile wallets, embedded BNPL | |

2029 | $1,438.64 Billion | 43.1% | Seamless, secure payment systems |

You can trust Zip Stores to keep leading the way in payment innovation.

FAQ

How do you use Zip in-store?

You open the Zip app, create a virtual Zip Card, and add it to your mobile wallet. At checkout, you tap your phone to pay. The app splits your purchase into installments.

Tip: Ask a store associate if you need help using Zip at checkout.

Does Zip charge interest or hidden fees?

You pay no interest when you use Pay in 4 or Pay in 8. Zip shows all fees before you buy. You always know the total cost.

Can you use Zip for any purchase amount?

Most stores set minimum and maximum limits for Zip purchases. You check the store’s policy before shopping. The Zip app also shows if your purchase qualifies.

What happens if you miss a payment?

Zip sends reminders before each due date. If you miss a payment, you may pay a small late fee. You should contact Zip support if you need help.

Is your information safe with Zip?

Zip uses secure technology to protect your data. The app keeps your payment details private. You can shop with confidence.

See Also

The Rise Of Intelligent Stores In Modern Convenience Retail

Cloudpick’s Role In Delivering Cashier-Free Shopping Experience

The Future Of Retail Lies In AI-Driven Stores

Transforming Online Retail With AI-Based E-Commerce Solutions

Smart Tech In Electronic Vending Machines Changing Retail Forever