Millennial vs Gen Z Adoption Rates: 70% of Gen Z prefer cashless transactions

Seventy percent of Gen Z prefer cashless payments, which is more than Millennials. Younger generations are adopting digital payment options at a faster rate now. Gen Z leads the way, with Millennials following closely behind. This highlights a clear trend between Millennial vs Gen Z preferences. Businesses are taking note of this shift, as young people desire speed and convenience. Stores that do not implement cashless payment systems may risk losing revenue. Gen Z specifically seeks instant and mobile payment solutions. Payment companies must adapt swiftly to keep pace with the high standards set by Gen Z.

Key Takeaways

Seventy percent of Gen Z like cashless payments. This shows many young people use digital payments instead of cash. Businesses need to offer cashless choices or they may lose customers. This is very important for younger people. Gen Z uses mobile wallets and payment apps the most. Ninety-one percent use digital payments first. Giving choices like Buy Now, Pay Later can bring in more young buyers. This can help stores sell more. Gen Z cares about safety and speed. They want payments to be fast and keep their information safe.

Cashless Transactions

Definition

Cashless transactions are when people buy things without using cash. They use digital payments instead. These can be mobile wallets, contactless cards, or online platforms. In North America, people use these digital payments the most:

Credit cards (34%)

Debit cards (6%)

People like digital payments because they are quick and simple. Gen Z and Millennials often use them for shopping, eating out, or even at vending machines. Digital payments let people pay by tapping or scanning. This makes paying faster and easier.

Importance

Digital payments have changed how people buy things. In the last five years, stores have started using more cashless payments. Now, stores take more digital payments than before. Here are some big changes:

Card payments went up from 45% in 2016 to 57% in 2021.

The total money spent with cards grew from $5.46 trillion in 2016 to $9.77 trillion in 2021.

E-commerce made 22.7% more money in 2020, so more stores started using digital payments.

In 2024, 96% of micro market transactions and all smart store transactions were cashless.

77% of vending machine sales used cashless payments.

People spend more at cashless micro markets and smart stores than at regular vending machines.

Digital payments also affect the environment. The table below shows some good and bad things:

Benefit/Challenge | Description |

|---|---|

Benefit | Less need to make cash, which saves resources and energy. |

Benefit | Less harm to the environment from making and moving money. |

Challenge | More energy is used by data centers for digital payments. |

Challenge | Old devices can become electronic waste if not recycled. |

Digital payments make shopping faster and easier. They help stores grow and keep up with new trends. Gen Z and Millennials want stores to have digital payment choices. Companies that offer these can get more customers and do better in the market.

Millennial vs Gen Z: Adoption Rates

Key Data

There are clear differences in how Millennials and Gen Z use digital payments. Gen Z is ahead in trying new ways to pay. Millennials are close behind, but there are still some gaps.

Here are some important facts:

91% of Gen Z use digital-first payments. This is more than any other age group.

Millennials are starting to use digital wallets, but Gen Z is faster.

In the US, UK, and Canada, Gen Z has a 79% rate for digital wallet use. Millennials have a 67% rate.

Generation | Adoption Rate of Digital Wallets |

|---|---|

Gen Z | 79% |

Millennials | 67% |

Gen Z uses mobile wallets in stores 23% more since 2022. Millennials only increased by 3.7%.

Millennials use up to nine digital wallets or services every day.

76% of Gen Z have tried peer-to-peer (P2P) payment services. 26% use them every week.

Both Millennials and Gen Z like other payment methods more than credit cards.

70% of Gen Z shoppers use Buy Now, Pay Later (BNPL) for things under $100.

Gen Z is leading the way with mobile payments. Millennials are changing too, but Gen Z is faster.

Comparison

Comparing Millennials and Gen Z shows some big trends. Gen Z likes cashless payments more than Millennials. Both groups use digital payments a lot, but Gen Z does it more.

Evidence | Description |

|---|---|

70% of Gen Z shoppers’ BNPL purchases | Are under $100, showing they buy small things often. |

76% of Gen Z consumers | Have used P2P services, and 26% use them every week. |

94% of retailers | Started using contactless payments during the pandemic. |

56% of firms | Took mobile wallet payments in 2021, up from 44% in 2020. |

Both Millennials and Gen Z use digital wallets and P2P payments more now.

Gen Z likes BNPL for small buys, showing new ways to spend.

Millennials are catching up, but Gen Z is still ahead with mobile wallets.

Gen Z does not want a world with no cash. Only 5% think the US will be cashless in five years. 70% of Gen Z do not want a cashless society. 55% of Millennials feel the same. Baby boomers also agree with Gen Z.

Generation | In-Store Mobile Wallet Usage Increase |

|---|---|

Gen Z | 23% |

Millennials | 3.7% |

Gen Z uses mobile wallets much more than older people.

Millennials use them more now, but Gen Z is faster.

The gap between Millennials and Gen Z in cashless payments is clear. Gen Z likes fast, digital, and mobile ways to pay. Millennials are moving toward these options, but Gen Z leads the way.

Digital Payments Preferences

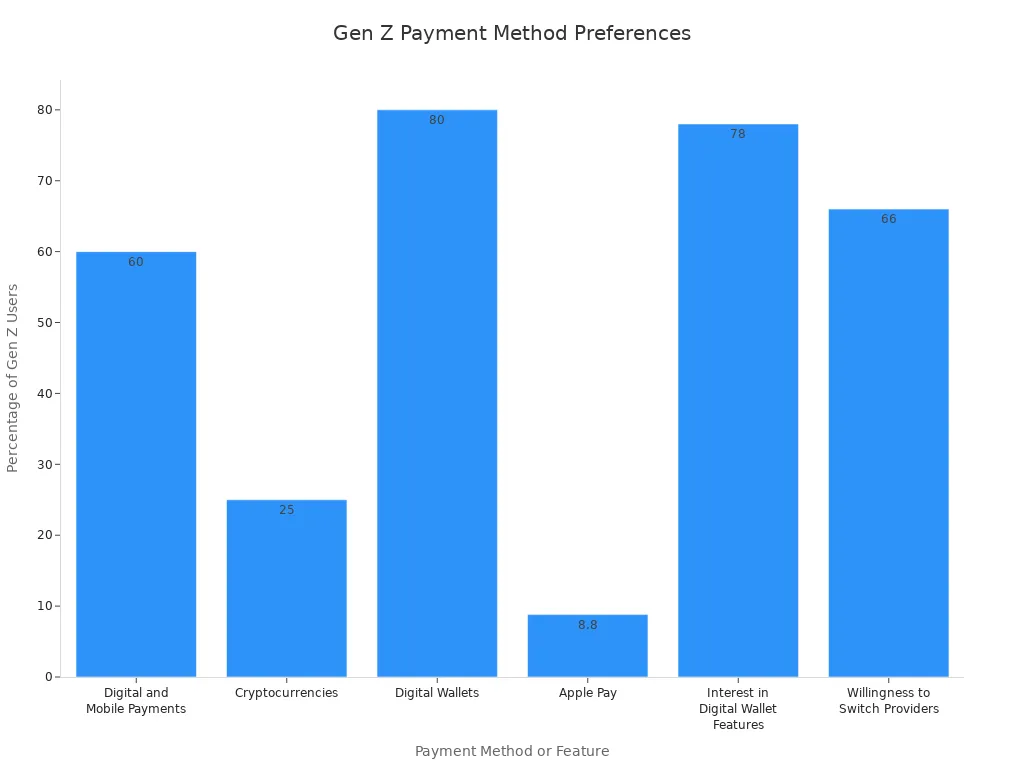

Mobile Wallets

Mobile wallets are very popular with Gen Z and millennials. They use them to shop, pay for coffee, and split bills. A survey found 66% of Gen Z and 67% of millennials use digital wallets more than cash or cards.

Generation | Percentage Using Digital Wallets |

|---|---|

Gen Z | 66% |

Millennials | 67% |

Gen Z likes mobile payments because they are fast and easy. Many use payment apps on their phones every day. About 57% of Gen Z use digital wallets, and 60% say their phones are their main way to buy things. Millennials use mobile wallets too, but Gen Z uses payment apps more often for daily spending. Both groups want payment options that are quick and simple.

Contactless Cards

Contactless payments are also a top pick for these groups. Millennials started using contactless cards much more, from 10% to 29% in a few years. Gen Z likes contactless digital payments too. Surveys show 54% of Gen Z prefer contactless, and half use contactless cards a lot.

Generation | Preference for Contactless Cards | Usage of Mobile Wallets | Use of P2P Payment Accounts | Flexible Payment Options |

|---|---|---|---|---|

Younger Millennials | High (lead in usage) | 78% rely regularly | Not specified | |

Generation Z | High (58% use social media apps) | Not specified | Not specified | 70% likely for BNPL |

Millennials like contactless payments because they are safe and easy. Gen Z likes them for speed and because they match their digital lifestyle. Both groups want stores to have contactless payment choices.

BNPL

BNPL, or Buy Now, Pay Later, is changing how people pay. Gen Z and millennials use BNPL for more control and flexibility. Gen Z has a 49% adoption rate, and millennials are at 56%.

Generation | Adoption Rate |

|---|---|

Gen Z | 49% |

Millennials | 56% |

Gen Z uses BNPL for small things, usually under $100. Millennials use BNPL for bigger items. Both groups like BNPL because it helps them pay without credit cards. BNPL is now important for stores that want to get more young customers.

Gen Z Shopping Trends

Motivations

Gen Z likes to shop quickly and easily. They want to pay fast and not wait in line. Many pick digital payments because they want things to work well and be simple. Friends can influence their choices. If friends use mobile wallets, Gen Z might try them too. They also look for stores with easy ways to pay and clear signs.

Security is very important to Gen Z. They care about privacy and want to keep their info safe. Most change privacy settings online and only share details when needed. Mobile wallets have extra safety, like encryption and tokenization. This helps Gen Z feel safer when they shop.

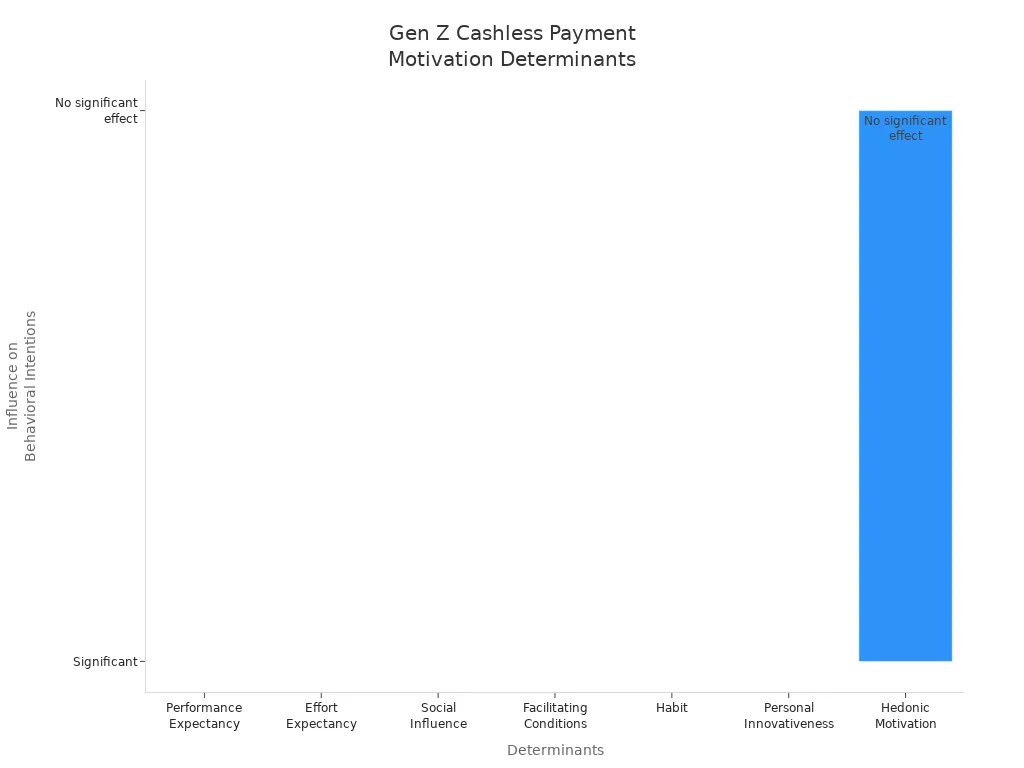

Gen Z is good with technology, and this shapes how they shop. They like to try new apps and features. They are open to using digital wallets and even cryptocurrencies. The table below shows what affects their choices:

Determinants | Influence on Behavioural Intentions |

|---|---|

Performance Expectancy | Significant |

Effort Expectancy | Significant |

Social Influence | Significant |

Facilitating Conditions | Significant |

Habit | Significant |

Personal Innovativeness | Significant |

Hedonic Motivation | No significant effect |

Habits

Gen Z shops online a lot and uses phones to pay. More than half like shopping with less talking to people. Many leave stores if they cannot use digital wallets. About 10% only use their phones to pay in stores.

Gen Z likes contactless payments, with almost 64% choosing this way.

Over half use personal credit cards when they shop.

Debit cards are also used by 46% of Gen Z.

Almost half do not feel safe with money, so they pick payment options that help them manage.

Gen Z shopping habits show a strong link between digital habits and payment choices. They want flexible options like Buy Now, Pay Later to avoid credit card debt. Gen Z likes digital wallets and payment apps. Millennials like peer-to-peer systems for rewards. Both groups use mobile wallets, but Gen Z uses digital more.

Gen Z feels comfortable with technology, and this affects how they shop. They switch to better wallet features and like storing more than just payment info. Businesses need to keep up with these habits to stay important.

Business Implications

Adapting Payments

Businesses know Gen Z and Millennials want digital payments. They want to pay fast, easily, and safely. Stores should give many ways to pay. Many people use monthly payment plans now. About 65% of Gen Z and Millennials use these for clothes, electronics, and groceries. Stores that offer Buy Now, Pay Later or virtual cards can get more shoppers. Companies must also make payments automatic and safer to stop cyber threats. Gen Z likes contactless digital payments, with 85% picking this way. For Millennials, 82% choose contactless too. These trends mean digital payments are now needed.

Popular purchases for installment plans include:

Clothing and fashion

Electronics and gadgets

Furniture and home décor

Home appliances

Groceries and everyday items

Personal travel

Tools and home improvement

Experiences and events

Exercise equipment

Marketing

Gen Z checks their mobile banking app 21 times each month. Millennials check 14 times a month. Most Gen Z want to open accounts using an app, not at a branch. Marketers should use mobile-first ads and show off digital payment features. Loyalty programs work well for both groups. Special deals, free perks, and quick discounts get their attention. The table below shows which rewards matter most:

Incentive Type | Description |

|---|---|

Exclusive Offers | Top incentive for Gen Z to join loyalty programs |

Free Perks | Highly desired by both generations |

Immediate Discounts | Important for instant gratification |

Saving Money | Key factor influencing payment choices |

Rewards Other Than Cash | Valued by Gen Z and Millennials |

Customer Experience

People want shopping to be easy and smooth. Gen Z wants fast digital payments and quick service. Millennials think payments will change a lot soon. Many already use their phones to manage money. Stores can help by giving real-time alerts, easy spending reports, and payment tracking tools. Companies like Monzo show how digital banking makes payments simple. The subscription economy keeps growing, which means people like flexible payment plans. When stores listen to Gen Z and Millennials, they build trust and keep customers coming back.

The subscription economy has grown 39.4% in one year, showing people want flexible and easy payments.

Gen Z is ahead when it comes to cashless payments. They use mobile wallets and digital services more than Millennials do. There are some important differences between the two groups.

39% of Gen Z use online cash a lot, but only 30% of Millennials do.

40% of Gen Z like using mobile wallets when they pay at the store.

Stores should give more ways to pay, like BNPL and digital wallets, so younger people will shop there. Watching payment trends helps stores do better and keeps shoppers coming back.

FAQ

What makes Gen Z prefer cashless payments?

Gen Z likes things to be fast and easy. They use their phones to pay with digital-first payments. Many do not want to carry cash. Stores with simple ways to pay get more Gen Z shoppers.

How do Millennials and Gen Z differ in payment habits?

Gen Z tries new payment apps quickly. Millennials use digital wallets but change slower. Both groups like shopping online, but Gen Z uses mobile wallets more.

Why should businesses offer more digital payment options?

Businesses get more sales with digital-first payments. Gen Z and Millennials want choices like BNPL and contactless cards. Stores that change keep their customers happy.

What role does fintech play in payment trends?

Fintech companies make new ways to pay. They help stores give safer and faster payments. Gen Z trusts fintech for shopping online and mobile banking.

Are cashless payments safe for young shoppers?

Most digital payments have strong security. Gen Z checks privacy settings and likes apps with encryption. Stores with safe payment systems earn trust from young buyers.

See Also

Cash Vending Machines: Transitioning From Coins to Digital Payments

Vending Machines: Advancements From Coins to Contactless Options

Cloudpick: Revolutionizing Your Store With Cashierless Convenience

Upcoming Changes to Walmart Self-Checkout Access in 2025

Zyn Vending Machines: Merging Convenience With Nicotine Technology