Why trump diplomacy always matters in chip retail

Trump diplomacy made big changes in the chip retail world. Reports say the trump administration wanted to protect U.S. businesses. They tried to bring factories back to the U.S. They also put rules and taxes on exports.

These actions helped U.S. companies compete better. But they also caused more problems with China and Europe.

Making more chips in the U.S. led to fewer tech products. It also made chip stock prices go up and down a lot.

Stores and buyers still deal with late shipments and higher prices.

Key Takeaways

Trump-era tariffs made chips cost more. This hurt shoppers and stores. Companies have to deal with these higher prices. They can look for new suppliers. They can also change how they set prices.

The CHIPS Act helps make more chips in the U.S. It pushes people to invest in American factories. Stores should help local chip makers. This can help them depend less on other countries.

Trade problems with China changed how chips are sold. Companies must know about new export rules. This helps them keep up with the changing market.

Stores need better ways to follow new rules. These rules are different in many places. They must check their supply chains carefully. They also need to know their customers well.

Stores must be quick to change in the chip market. They should watch for new rules. They need to be ready to change how they work. This helps them avoid problems and find new chances.

Trump Administration: Supply Chain Impact

Tariffs and Controls

The trump administration made new rules called tariffs. These rules changed how chips are bought and made. The goal was to make more chips in the U.S. and use fewer from other countries. Many companies thought they would have to change how they get chips. But old supply chains stayed strong. Reports show trade between the U.S. and other countries did not drop. Companies still used their usual ways to get chips, even though tariffs made things cost more.

Prices for chips and products that use chips changed a lot. The table below shows what experts said about how tariffs changed prices and the chip business:

Impact on Pricing | Expert Opinion |

|---|---|

Increased costs for consumers | Miller said most costs would be paid by shoppers. |

Uncertainty in the industry | Nick Marro said tariffs made things less certain. |

Potential inflationary effects | Michael Strain said tariffs could make goods cost more. |

Tariffs made electronics and other products that need chips cost more. The main goal was to make more things in the U.S. and buy less from other places. Higher costs hit both things made in the U.S. and things brought in from other countries. Stores had trouble keeping prices fair and getting enough products. Uncertainty made it hard for stores to follow the rules.

TSMC is a big company that makes chips.

TSMC warned the U.S. that new tariffs on chips from Taiwan could make people buy fewer chips. This could hurt TSMC’s promise to spend more money in Arizona. TSMC said any new tariffs or rules should give enough time for TSMC Arizona and other U.S. companies to adjust. These companies already spent a lot to make chips in the U.S.

Tariffs made it hard to know what chips would cost and how many people would buy them. TSMC worried that fewer people would want chips and that their plans in the U.S. could be hurt. Higher costs at every step made things tough for U.S. companies and shoppers. The world market for chip parts was already stressed, and tariffs made prices go up even more.

The trump administration also made deals with companies like Nvidia and AMD.

The deal let them sell weaker AI chips to China for a 15% fee.

This was different from letting the market decide everything. It made people worry about how the U.S. would compete with other countries.

The deal could bring in over $2 billion for the U.S. government, even though there were limits on selling AI chips to China.

Domestic Production Push

The trump administration wanted more chips made in the U.S. They used rules like the CHIPS Act, OBBB policy, and special orders. These rules tried to help companies make more chips here and buy less from other countries. The CHIPS Act got big companies like TSMC, Intel, and Samsung to invest in U.S. factories. Clear money rules helped these companies grow in the U.S.

But some rules did not match up. Trump did not always support the CHIPS Act, and his tariffs made chips cost more. This could make companies not want to build factories in the U.S.

The CHIPS Act gave rewards to companies that made chips in the U.S.

Big companies promised to make more chips here.

Tariffs made both U.S. and imported chips cost more, which changed prices and supply.

Rules that did not match made it hard for companies to plan and invest for the future.

Stores and factories have to deal with these tricky rules. They try to keep enough chips while facing higher costs and not knowing what will happen next. The push to make more chips in the U.S. is still important, but tariffs and changing rules make things hard for everyone.

Trump Diplomacy and Geopolitics

China Trade Tensions

Trump diplomacy changed how the U.S. deals with trade fights, especially with China. When Trump was president, the U.S. put big tariffs on things from China. China called this "trade bullyism." This made both countries more upset with each other. It also changed how they work with semiconductors. The U.S. started using tariffs and export controls for national security, not just money. These moves started a trade war that still affects the market today.

U.S. semiconductor exports have gone down about 2.6% each year since these problems began.

Chinese imports of semiconductors have dropped by over 11% every year.

The U.S. raised tariffs to 25% on $200 billion of Chinese goods, which made trade fall fast.

Export control lists now stop technology from going to China, especially in semiconductors.

The U.S. also put companies like Huawei on the Entity List. This stopped Chinese companies from buying important U.S. technology. Now, both countries want to build their own chip industries. They do this so they do not have to depend on each other.

Global Retail Effects

Trump diplomacy did not just change things for the U.S. and China. It also changed the world’s chip market. Many countries now try not to depend on just one place for chips. The Chip 4 Alliance was made to help countries rely less on China. This group controls most of the world’s semiconductor market.

Evidence | Description |

|---|---|

Made it harder for companies that import semiconductors and raised their costs. | |

Shift in Trade | Countries look for new partners so they do not depend too much on the U.S. |

This group now controls 82% of the semiconductor market. |

Higher costs and not knowing what will happen next are hard for new hardware companies and big companies. The Trump administration’s actions led to new rules on rare earth exports from China. Both countries have spent a lot of money to make their own industries stronger. This fight between the U.S. and China keeps changing global chip retail and partnerships around the world.

Semiconductor Retailer Strategies

Compliance and Risk

Semiconductor retailers changed how they follow rules after new export controls. They now try to follow rules in many countries, not just the U.S. Companies look at their technology and supply chains to get ready for new rules. They also check customers closely to make sure products do not go to bad places.

Compliance Strategy | Description |

|---|---|

Multi-jurisdictional export compliance | Retailers follow rules in many countries as more places make similar laws. |

Technology and supply chain analysis | Companies check their technology and supply chains for new controls. |

Know Your Customer (KYC) diligence | Firms look at customers carefully to stop products from going to wrong places. |

The Trump administration stopped some ways to get around export rules, especially for China. Government groups now work harder to make sure rules are followed. New rules focus on high-performance integrated circuits and special equipment. Some rules also stop access to supercomputers and making technology. These steps help the U.S. stay ahead in semiconductor technology and lower risks from other countries.

Retailers also changed how they handle risks. The government made some rules easier for AI developers, so companies changed how they manage risks. Some companies now have fewer limits, but they still watch for new problems. Because the U.S. wants to stay strong in technology, retailers must be ready for changes.

Adaptation Examples

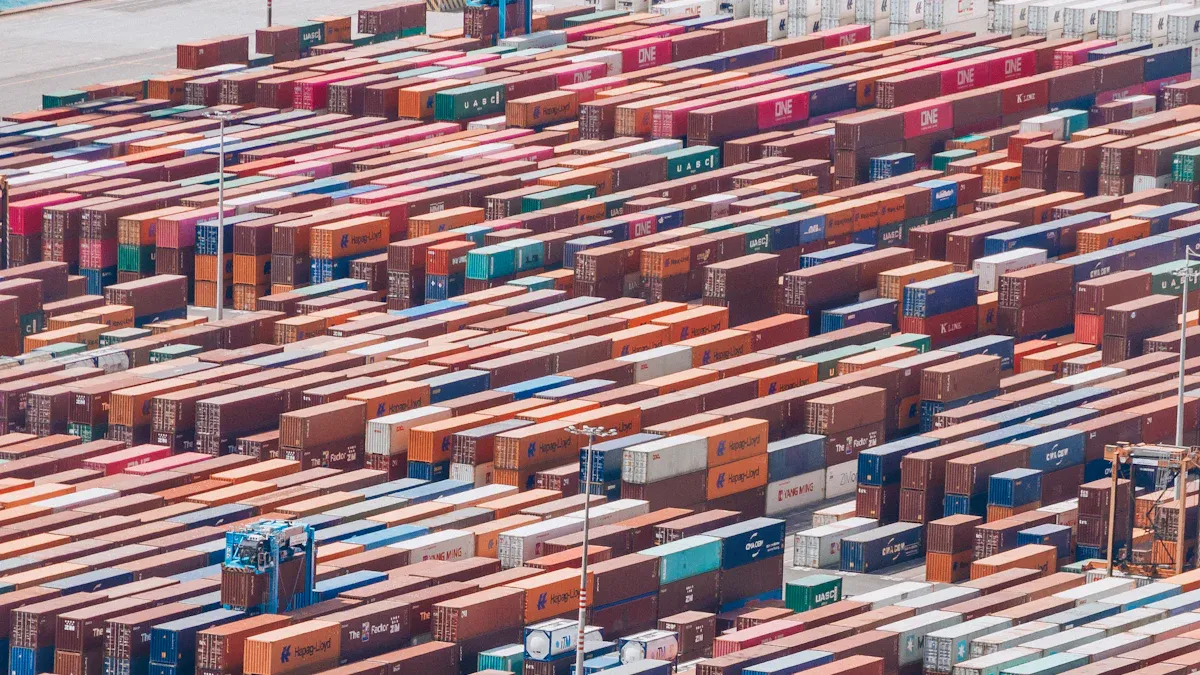

Retailers changed their supply plans to adapt. The 2025 tariffs made companies think about where they get products. Many now look at bringing work back home, working with nearby countries, and using more suppliers. These steps help lower risks and keep products coming.

Companies buy early to stop shortages.

They find new suppliers in other places.

They make local supply chains stronger.

Tariffs made things cost more and brought new problems. Retailers now buy ahead and use more suppliers to handle risks. Experts think these changes will make supply chains stronger and more local over time. Semiconductor retailers must keep changing to follow new rules and market changes to protect their supply and stay strong.

Future of Trump Diplomacy in Semiconductors

Policy Legacy

Trump’s choices still change the chip industry today. Many rules now focus on making the U.S. stronger and safer. The table below shows how old actions still shape today’s rules and rewards:

Evidence Type | Description |

|---|---|

Trump did not like this act. It is being looked at again, so project money could change. | |

Tariff Implementations | Tariffs on imports, mostly from China, mess up supply chains around the world. |

Export Controls | New export controls follow Trump’s ideas. They stop China from getting some technology. |

Deregulation | Trump wanted fewer rules. This could help U.S. factories grow. |

Trump wanted TSMC to make more advanced chips in the U.S. This made people in Taiwan think the U.S. might not be a good partner.

Trump’s push for TSMC to move more chip-making to the U.S. makes some in Taiwan feel the U.S. is not always a reliable friend.

Section 232 checks started with Trump. These checks made national security very important for making chips. The goal to make more chips in the U.S. still leads to new rewards and plans for better factories.

Retailer Outlook

Retailers need to get ready for more changes soon. The tariff plan is still here, so companies pay more and must change their plans. Many now use rewards to build local supply chains and be more independent. The next meeting between Trump and Xi Jinping could change trade rules again. Retailers should watch for new rules and be ready to change fast.

Tariffs may make prices go up and down more.

Retailers should use rewards to lower risks.

Companies need a plan to make supply chains stronger.

Building better factories will help them grow later.

A new deal with Nvidia and AMD sends 15% of some chip sales to China back to the U.S. Treasury. This shows Trump’s way of doing things still shapes money plans. The tariff plan is still in place, so retailers must keep finding ways to stay strong as things change.

Trump-era diplomacy still changes how chips are sold. It affects supply chains, prices, and store plans. Reports say tariffs and new rules made companies change how they get chips. These changes also made things cost more and pushed for more chip factories in the U.S.

Key Takeaway | Description |

|---|---|

Strategic Realignment | Companies made supply chains stronger and used more sources. |

Supply Chain Disruptions | Higher costs and delays made companies find new ways to get chips. |

Shifts in Manufacturing | Some companies moved work to Southeast Asia and other places. |

Domestic Investment Push | More money went into making chips in the U.S. |

Retailers still have problems like higher tariffs and tough export rules. Experts say stores should do these things to stay ready:

Watch for new rules from groups like the Semiconductor Industry Association.

Use more suppliers and build better rule-following systems.

Sign up for news to get updates fast.

If stores keep learning and can change quickly, they can handle risks and be ready for more changes in the chip market.

FAQ

What is Trump diplomacy in chip retail?

Trump diplomacy means the trade rules and tariffs made when Donald Trump was president. These rules changed how companies buy, sell, and make semiconductors in the U.S. and other countries.

How do tariffs affect chip prices?

Tariffs make it cost more to bring in chips and products. Stores usually make shoppers pay these higher costs. This means electronics and other things can cost more at the store.

Why do chip retailers care about export controls?

Export controls say where companies can sell advanced chips. Retailers must follow these rules or they could get fined or lose their business license. They also have to check customers and supply chains more carefully.

Will Trump-era policies keep affecting chip retail?

Yes. Many rules and trade problems started when Trump was president. These rules still change how companies get chips, set prices, and decide where to invest today.

See Also

The Future of Convenience Retail: Smart Store Innovations

AI-Driven Corner Stores: Essential Insights for Retailers

Understanding Corner Stores: Their Importance in Retail

The Future of Retail: Embracing AI-Powered Stores

Discovering What Makes Seminole's Corner Store Travel Center Unique