The Evolution of Vending Machine Bill Acceptors: From Coins to Big Bills

You experience a major shift when you use vending machine bill acceptors instead of coins. This change brings new levels of convenience and security. Advanced technologies like AI and IoT now help machines check bills more accurately, which lowers the chance of fraud. Real-time monitoring lets operators manage cash flow with greater efficiency. In places such as public transportation, seamless cash transactions become possible. You see how innovation makes vending machines smarter and safer for everyone.

Key Takeaways

Vending machines have evolved from using only coins to accepting larger bills, making purchases faster and easier.

Modern bill acceptors use advanced technology like cameras and sensors to detect counterfeit money and ensure secure transactions.

Cashless payment options, such as credit cards and mobile wallets, are becoming more popular, offering convenience and speed.

Vending machines now provide a better user experience with clear instructions and quick processing, reducing wait times.

The future of vending machines includes even smarter features, like AI and biometric verification, enhancing both security and convenience.

History of Vending Machine Bill Acceptors

Early Coin Mechanisms

You might wonder how cash vending machines started. In the early days, these machines relied on simple coin mechanisms. When you dropped a coin into the slot, the machine used its weight to trigger a dispensing action. A lever connected to a pan would activate a valve, releasing the product. Once the coin slipped off the pan, the flow stopped, so you always received the right amount.

Feature | Description |

|---|---|

Coin Activation | The mechanism used the weight of a coin to trigger a dispensing action. |

Lever Mechanism | A lever connected to a pan would activate a valve to dispense the product when the coin was inserted. |

Dispensing Control | The flow of the product would stop once the coin slipped off the pan, ensuring controlled dispensing. |

Early coin mechanisms made cash vending machines reliable and easy to use. You could trust that your coin would give you the product you wanted.

First Bill Acceptors

As you moved into the 1970s, vending machine bill acceptors began to change the way you paid. You no longer needed only coins. Machines started to accept bills, making purchases easier and faster. The introduction of bill validators helped prevent fraud and errors. You saw new models like the BCX Bill and Coin Exchanger Series, which allowed you to use both coins and bills.

Here are some key milestones in the development of bill acceptors:

Year | Milestone Description |

|---|---|

1964 | Introduction of $1 bill acceptance in U.S. Change Machines, enhancing competitive advantage. |

1978 | Introduction of $5 bill acceptance into the changer line. |

1987 | Launch of the System 500 Bill Acceptor, accepting $1, $5, $10, and $20 bills. |

1998 | Introduction of the System 600-FST, addressing fraud and theft challenges. |

2000 | Launch of the BX Bill-to-Bill Exchanger Series, dispensing bills for Laundry Card store owners. |

You noticed that cash vending machines became more advanced. Bill acceptors could handle larger bills and offered better security. The bill-to-bill exchanger made it easier for you to get change in bills instead of coins. These changes improved your experience and made vending machines more useful for everyone.

Modern Bill Acceptors

Advanced Technology

You see how modern vending machine bill acceptors use advanced technology to make your experience smoother and safer. These machines now include cameras, photocells, and sensors that help them recognize bills quickly and accurately. Cameras work in different lighting conditions and can spot both static and moving images on your bills. Photocells scan the unique patterns and stripes on each note, much like how a shopkeeper checks a bill under a light. This technology helps the machine tell real money from fake.

Here is a table showing some of the main technologies you find in today’s bill acceptors:

Technology Type | Description |

|---|---|

Cameras | High resolution, operates in various lighting conditions, supports static and dynamic visual recognition. |

RFID Technology | Enables efficient inventory tracking and facilitates cashless payments, streamlining the purchasing process. |

Gravity Sensors | Ensures correct product dispensing and detects tampering or security threats. |

Static Recognition | Monitors stock levels and ensures displayed items match available products, enhancing inventory accuracy. |

Dynamic Recognition | Real-time monitoring of transactions, preventing fraud and improving user experience. |

You can now use larger bills in cash vending machines. The bill acceptor reads the denomination and checks for authenticity before accepting your money. Many machines also give you change in both coins and bills, which makes transactions easier for you. This level of innovation means you spend less time worrying about exact change and more time enjoying your purchase.

Tip: If you ever wonder why your bill gets rejected, it might be because the machine’s sensors detected something unusual. Try smoothing out the bill or using a different one.

Security Features

You benefit from strong security features in modern bill acceptors. These machines use several methods to spot counterfeit money and prevent fraud. Cameras and photocells look for special markings and patterns on each bill. The bill acceptor uses UV and magnetic sensors to check for hidden features that only real bills have. Machines also measure the size and weight of coins to make sure they match the right specifications.

Here are some of the most effective security features you find in today’s bill acceptors:

High precision sensors reject bills with an error rate below 0.1%.

UV, magnetic, and infrared sensors detect counterfeit bills by checking for special inks and hidden marks.

Fluorescence detection checks the paper quality and how it reacts under blue light.

Magnetic detection analyzes the magnetic ink used in real currency.

Infrared penetration detection looks at the thickness and density of the paper and ink.

Laser detection reveals hidden fluorescent characters that are hard to copy.

You see these security features in many places, such as gaming machines and banks. In gaming machines, they help prevent fraud and keep the games fair. In banks, they help track transactions and meet strict rules.

Application Area | Role of Security Features |

|---|---|

Gaming Machines | Prevent fraud and ensure regulatory compliance through features like counterfeit detection and anti-fishing mechanisms. |

Banking | Enhance customer service and meet regulatory requirements with features such as transaction logging and remote monitoring. |

You can trust that modern vending machine bill acceptors keep your money safe. The combination of advanced technology and strong security features means you get reliable service every time you use a machine.

Payment Options Today

Cashless Methods

You now have more ways to pay at vending machines than ever before. Cashless transactions have become very popular. You can use digital payment systems that let you buy snacks or drinks without using coins or bills. Most machines accept major credit and debit cards. You can also use mobile payment options like Google Wallet or other mobile wallets. These methods make buying quick and easy.

Major credit and debit cards

NFC (Near Field Communication) for contactless payment systems

Mobile payment options are especially helpful if you do not carry cash. You just tap your phone or card, and the machine processes your order in seconds. Digital payment systems also help operators offer more products, including higher-priced items. You may notice that cashless card readers make it easier for you to buy what you want, even if you decide at the last minute.

The cashless vending machine market is growing fast. Experts expect it to grow about 15% each year from 2021 to 2026. This growth comes from new technology and your preference for digital payment systems. The COVID-19 pandemic made touchless payments even more important for safety.

Here is a table that shows why you might prefer cashless transactions:

Feature | Benefit |

|---|---|

Transaction Speed | Cashless payments are faster and remove the need to handle cash. |

User Satisfaction | You enjoy the convenience, speed, and hygiene of cashless transactions. |

Impulsive Purchases | Quick payments make it easier to buy on impulse. |

Continued Demand for Cash

Even with all these new ways to pay, you still see cash vending machines in many places. Some people prefer cash for privacy and security. Cash payments do not leave a digital trail, which can be important if you worry about financial surveillance. In some regions, people rely on cash because it feels safer or more familiar.

The cash segment in vending machines is expected to grow by about 1.9% each year from 2025 to 2030.

Many areas still depend on cash transactions.

Cash offers privacy and security, especially where people do not trust digital systems.

You can choose the payment method that works best for you. Whether you use cash, a card, or your phone, vending machines keep getting better at meeting your needs.

Impact on Users and Operators

Usability

You notice that vending machine bill acceptors make your experience much easier. When you use a machine, you want it to work quickly and accept your money without problems. Modern machines let you insert different bill denominations, and the screen shows your credit right away. If you try to use a bill that is too large, the machine rejects it and gives you a clear message. This helps you avoid confusion and saves time.

Usability studies test how well these machines work for you. They check if the machine credits your money correctly, rejects bills outside the limit, and handles errors with clear instructions. Here is a table that shows how experts test usability:

Testing Aspect | Description |

|---|---|

Bill acceptor | Test by inserting different denominations to ensure proper crediting and display on the screen. |

Accepted bills | Verify that the machine rejects bills larger than its stated limit to prevent customer confusion. |

Error handling | Assess how the machine manages errors, such as damaged bills or insufficient funds, with clear messages. |

You benefit from these features because you spend less time figuring out how to use the machine. You also feel more confident that your money is safe.

Efficiency

You want fast service, especially in busy places like schools or train stations. Vending machine bill acceptors help operators serve more people in less time. These machines process payments quickly and reduce the need for staff to handle cash. Operators save money because the machines lower the risk of mistakes and theft.

The use of vending machine bill acceptors in high-traffic areas keeps lines short and customers happy. Operators also see lower costs because machines handle both cash and digital payment systems. This means you can pay with cash or use cashless transactions, depending on your preference.

Here is a table that shows how efficiency improves with modern machines:

Evidence of Efficiency Improvement | Description |

|---|---|

Reduced Queues | Self-service kiosks minimize wait times, enhancing customer satisfaction. |

Expanded Payment Options | Kiosks cater to both cash and digital payment preferences, increasing accessibility. |

Streamlined Bill Payments | Automation of bill payments reduces the risk of missed payments and saves time. |

You see these improvements every day. Machines work faster, and you have more ways to pay. Operators can manage more machines in more places, which keeps your favorite snacks and drinks available.

Future Trends

Emerging Technologies

You will see vending machines become even smarter in the coming years. New technology will change how you pay and interact with these machines. Artificial intelligence (AI) will help machines suggest products based on what you like. The Internet of Things (IoT) will let operators track inventory and fix problems before you notice them. Biometric verification, such as facial or fingerprint recognition, will make your payments more secure and touchless. This is important for your safety and convenience.

Technology | Impact on Vending Machines |

|---|---|

AI | Enables smart product recommendations based on consumer behavior |

IoT | Facilitates real-time inventory tracking and predictive maintenance |

Biometric Verification | Enhances security, preventing unauthorized access and fraud |

Cashless Payments | Digital wallets and contactless cards become the norm |

You will also find more machines that accept mobile wallets, QR codes, and even wearable devices. Touchless features like gesture controls and voice commands will reduce the need to touch buttons. These changes will make your experience faster and safer.

Note: Biometric technologies, such as facial and voice recognition, are growing quickly. They help you pay without touching anything, which is great for health and security.

Industry Outlook

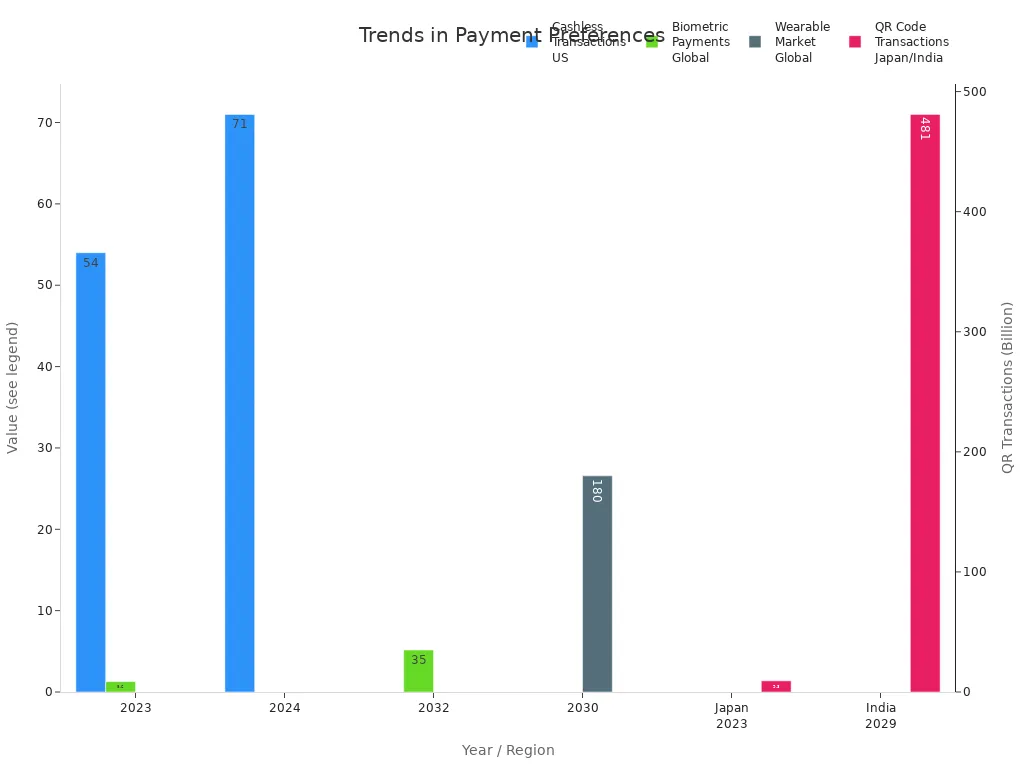

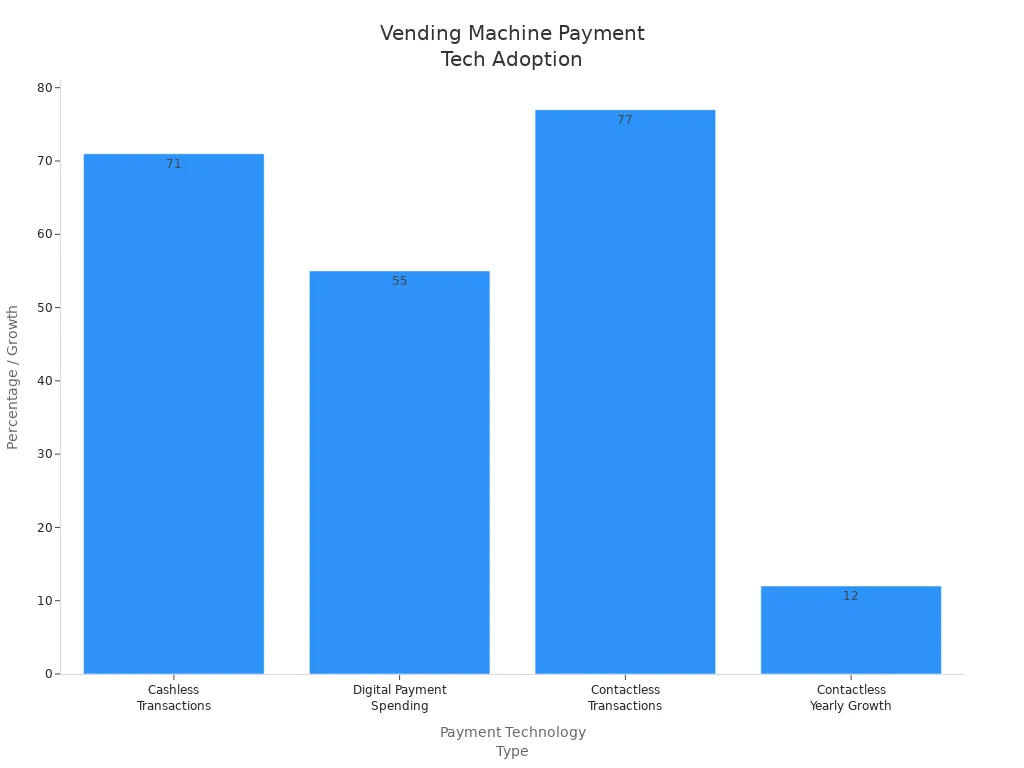

You can expect the vending machine industry to keep growing as more people use digital payment systems. In the United States, 71% of vending sales are now cashless transactions. People spend more when they use digital payments, with the average amount per sale rising by 55% compared to cash. In Europe, over half of consumers prefer cashless options, and some countries use almost no cash at all.

Trend | Implication |

|---|---|

Enhanced Security Features | Improved protection against counterfeit bills, increasing user trust and market adoption. |

Increased Speed and Efficiency | Faster transaction processing, enhancing customer experience and operational efficiency. |

Connectivity and Data Analytics | Enables remote monitoring and insights into sales patterns, optimizing business operations. |

Regulatory Compliance | Ensures products meet legal standards, affecting market access and product development. |

Cashless Payment Adoption | While cashless methods rise, bill acceptors remain vital in cash-based economies. |

Custom Solutions | Tailored offerings to meet specific application needs, enhancing market penetration. |

Mergers and Acquisitions | Consolidation among major players to strengthen market position and expand product offerings. |

You will see more machines with faster processing, better security, and smarter features. Operators will use data to keep machines stocked and working well. Even as cashless options grow, bill acceptors will still matter in places where people use cash. The future of vending machines will focus on innovation, making your experience easier and more secure.

You have seen vending machines move from coins to bills and now to digital payments. This journey has made buying snacks faster and safer.

Evolution Stage | Key Impact on Convenience | Key Impact on Security |

|---|---|---|

Coin-only systems | Limited options, slower transactions | Higher risk of theft and fraud |

Introduction of bill acceptors | Faster payments with paper money | Counterfeit detection improved |

Digital payment integration | Seamless, cashless experience | Advanced fraud protection |

Today, you enjoy more ways to pay and better security. Cashless payments can boost revenue by up to 30%. New features like voice commands and digital displays make vending machines smarter. You will see more contactless and mobile payments, QR codes, and even subscription services in the future. Security will stay a top priority, helping you trust every transaction.

FAQ

What should you do if a vending machine rejects your bill?

You can try smoothing out the bill or using a different one. Machines often reject bills with folds, tears, or dirt. If the problem continues, you can contact the operator using the number on the machine.

Can you use large bills in all vending machines?

Most modern machines accept $1, $5, $10, and $20 bills. Some older machines only take smaller bills. You should check the sticker or display on the machine before inserting your money.

Tip: Always look for the accepted bill denominations listed near the bill slot.

How do vending machines detect fake bills?

Machines use sensors like UV, magnetic, and infrared to check for special marks and inks. Cameras and photocells scan patterns on the bill. These tools help the machine spot counterfeit money quickly.

Sensor Type | What It Checks |

|---|---|

UV | Special inks |

Magnetic | Magnetic strips/inks |

Infrared | Paper thickness |

Are cashless payments safer than using cash?

Cashless payments offer extra security. You avoid handling money, and your transaction gets encrypted. You also reduce the risk of theft or loss. Many people feel safer using cards or mobile wallets.

Why do some people still prefer cash for vending machines?

You may choose cash for privacy. Cash payments do not leave a digital record. Some people trust cash more, especially in places where digital systems are less common.

See Also

Vending Machines: Transitioning From Coins To Larger Bills

Cash Vending Machines: Evolving From Coins To Digital Options

Understanding Vending Machines: Managing Large Bills Efficiently

Vending Machines: Advancing From Coins To Contactless Transactions

Vending Machines: Progressing From Snacks To Intelligent Tech